Note: For the exercises and problems in this chapter, use the following tax rates: FICAEmployer and employee,

Question:

Note: For the exercises and problems in this chapter, use the following tax rates:

FICA—Employer and employee, 8% of the first $70,000 of earnings per employee per calendar year.

State unemployment—4% of the first $8,000 of earnings per employee per calendar year.

FUTA—1% of the first $8,000 of earnings per employee per calendar year.

Federal income tax withholding—10% of each employee's gross earnings, unless otherwise stated.

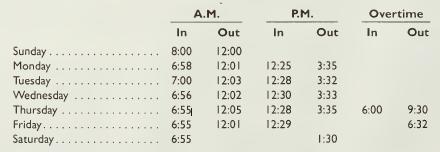

Computing payroll earnings and taxes LO1,2. Hickey of King Edward Manufacturing Company is paid at the rate of $15 an hour for an 8-hour day, with time-and-a-half for overtime and double-time for Sundays and holidays. Regular employment is on the basis of 40 hours a week, five days a week. The regular workday is from 7:00 a.m. to 12:00 noon and from 12:30 p.m. to 3:30 p.m. At the end of a week, the clock card shows the following:

On Monday through Friday night, Hickey worked on the production line. The hours worked on Saturday and Sunday were used to repair machinery.

a. Compute Hickey's total earnings for the week. (Ignore odd minutes.)

b. Present the journal entry to distribute Hickey's total earnings.

Step by Step Answer: