Product life-cycle costing and pricing Fish-Tech Products, Inc makes many high-tech products for home and recreational use.

Question:

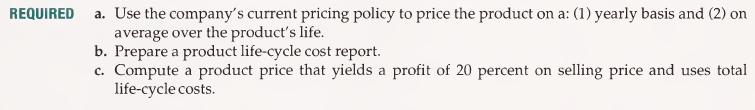

Product life-cycle costing and pricing Fish-Tech Products, Inc makes many high-tech products for home and recreational use. For the past several years, the company's pricing policy has been to price at 250 percent of standard per unit manufacturing cost. The company's new product engineering staff has been working on a new combined sonar-Loran-C unit (a fish and depth finder with geographic locational capabilities). This new product has been in design and testing for about 18 months, and it is hoped it will go into production in about six months. The estimated standard costs are listed below for the three-year expected product life of these units.

The firm expects some improvement in prime costs over the life of the product. This occurs because of reduction in costs of purchased material components, less scrap, and general learning effect that occurs in the production process. Sales estimates are 8,000 units in year 1,10,000 units in year 2, and 5,000 units in year 3.

Product engineering estimates that the 6,000 hours of laboratory testing will have gone into this product before it goes into production. Ongoing testing of the product during its life should average 500 hours a year. Research and Development charges $90 per hour for lab testing. Product Engineering will invest 15,000 hours in product design and production process design by the time the first product is made. Their time is charged at $60 per hour. Plant tooling for the new product is estimated at $450,000.

The marketing program will target major boating and fishing magazines plus occasional television commercials on outdoors shows. Marketing and distribution costs should average $35 per unit. Costs of warranty repairs and customer and dealer service is expected to be $220,000, the first year, $380,000 the second year, and $150,000 the third year. Residual warranty work after the product is eliminated should total $120,000 over the next five years.

Step by Step Answer: