Refer to the information in Exercise 20-34. Required: 1. Calculate free cash flow at Williams Company for

Question:

Refer to the information in Exercise 20-34.

Required:

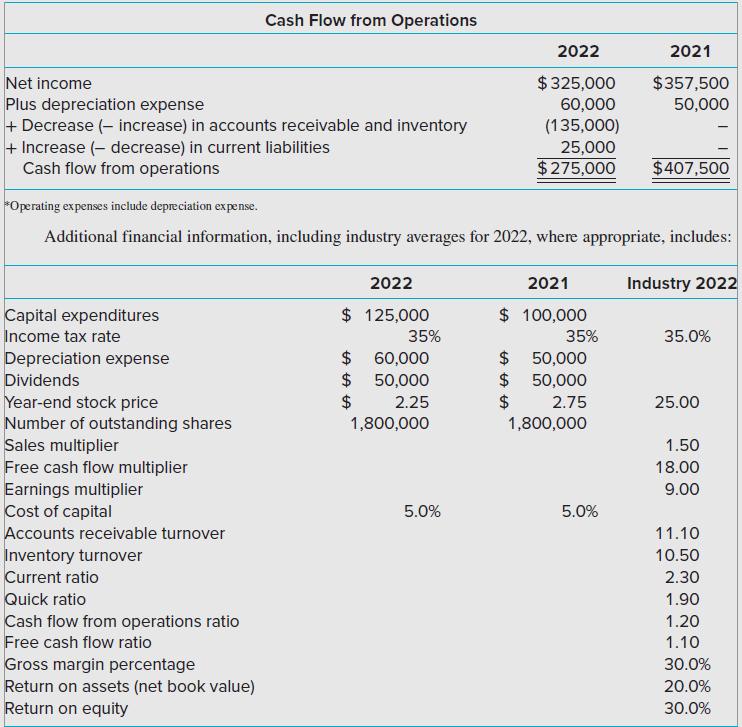

1. Calculate free cash flow at Williams Company for each of the two years.

2. Develop a business valuation for Williams Company for 2022 using the following methods:

(1) Book value of equity,

(2) Market value of equity,

(3) Discounted cash flow (DCF),

(4) Enterprise value,

(5) All the multiples-based valuations for which there is an industry average multiplier.

For the calculation of the DCF valuation, you may use the simplifying assumption that free cash flows will continue indefinitely at the amount in 2022.

Exercise 20-34.

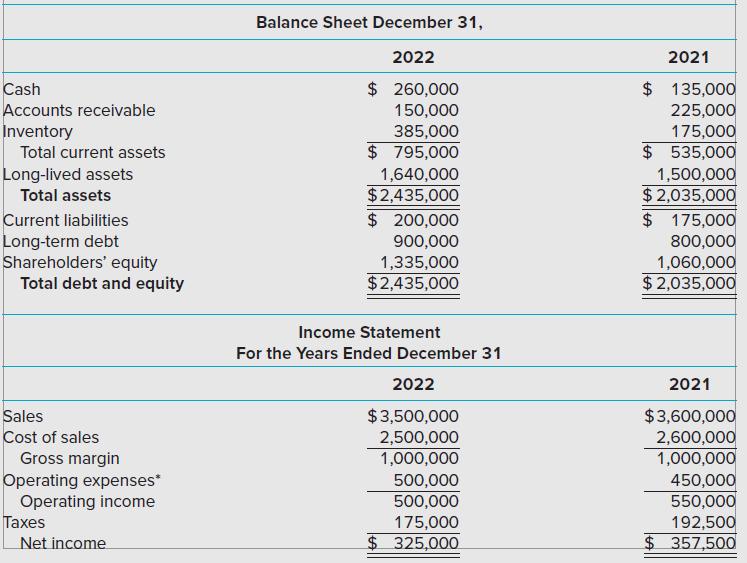

Williams Company is a manufacturer of auto parts having the following financial statements for 2021–2022.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: