You are the asset manager for an international fund. Suppose you enter into an unhedged currency swap

Question:

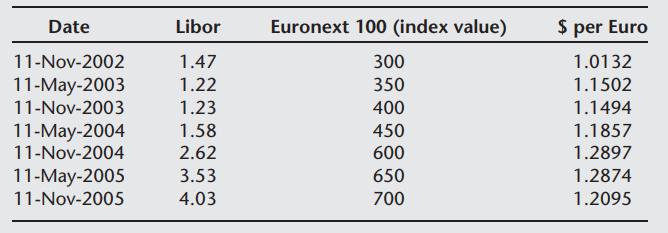

You are the asset manager for an international fund. Suppose you enter into an unhedged currency swap in which you receive the return on the Euronext 100 index and pay the Libor rate. The swap is on a half yearly basis for three years and is unhedged, i.e., payments will reflect current exchange rates. The following is the experience of the

Assume that the convention on the interest rates is Actual/360 and the swap has a variable notional principal. Prepare a table showing the payments and receipts on this swap. The notional principal at inception is $100,000.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: