You currently own a portfolio that is invested in broad equities and is worth $120,000. You wish

Question:

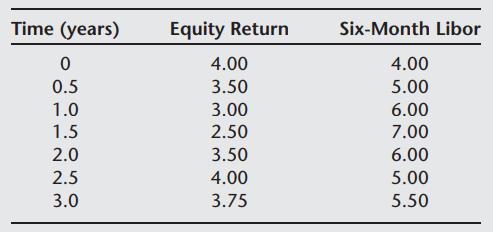

You currently own a portfolio that is invested in broad equities and is worth $120,000. You wish to diversify some of the equity risk going forward and maintain a portfolio that is only 70% equity and 30% cash (Libor) for the next three years. Hence, you add a variable notional equity swap to the portfolio such that the portfolio is rebalanced every half year. The following table gives the annualized returns on equity and the Libor rates for the next three years. Prepare a table showing the value of the portfolio, the notional principal of the swap, and the payments made or received under the swap contract. Assume, for simplicity, that all payments including Libor are made on a 30/360 basis. The net portfolio each period is computed after taking the asset value into account as well as the net payments on the swap.

The equity return at time t stands for the rate of appreciation over the past six months ending at time t. The Libor rate at time t stands for the Libor rate at time t and, hence, applies to the next half year.

Step by Step Answer: