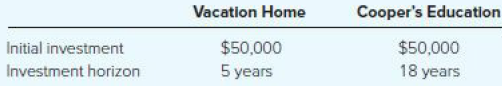

Alan inherited $100,000 with the stipulation that he invest it to financially benefit his family. Alan and

Question:

inheritance to help them accomplish two financial goals: purchasing a Park City vacation home and saving for their son Cooper€™s education.

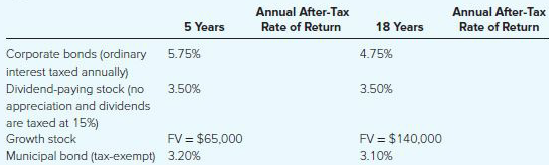

Alan and Alice have a marginal income tax rate of 32 percent (capital gains rate of 15 percent) and have decided to investigate the following investment opportunities.

Complete the two annual after-tax rates of return columns for each investment and provide investment recommendations for Alan and Alice.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Essentials Of Federal Taxation 2019

ISBN: 9781260190045

10th Edition

Authors: Brian Spilker, Benjamin Ayers, John Robinson, Edmund Outslay, Ronald Worsham, John Barrick, Connie Weaver

Question Posted: