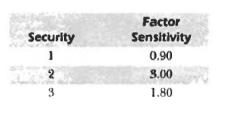

4. Assuming a one-factor model, consider a portfolio composed of three securities with the following factor scnsivities:

Question:

4. Assuming a one-factor model, consider a portfolio composed of three securities with the following factor scnsivities:

If the proportion of security I in the portfolio is increased by .2, how must the proportions of the other two securities change if the portfolio is to maintain the same factor sensitivity?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Investments

ISBN: 9788120321014

6th Edition

Authors: William F. Sharpe, Gordon J. Alexander, Jeffery V. Bailey

Question Posted: