5. Assuming a one-factor model of the form: r, = 4% + b;l'+ P.i consider three well-diversified...

Question:

5. Assuming a one-factor model of the form:

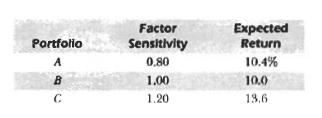

r, = 4% + b;l'+ P.i consider three well-diversified portfolios (zero nonfactor risk) . The expected value of the factor is 8%.

Is one of the portfolio's expected return not in line with the factor model relationship?

Which one? Can you construct a combination of the other two portfolios that has the same factor sensitivity as the "out-of-line" portfolio? What is the expected return of that combination? What action would you expect investors to take with respect to th ese three portfolios?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Investments

ISBN: 9788120321014

6th Edition

Authors: William F. Sharpe, Gordon J. Alexander, Jeffery V. Bailey

Question Posted: