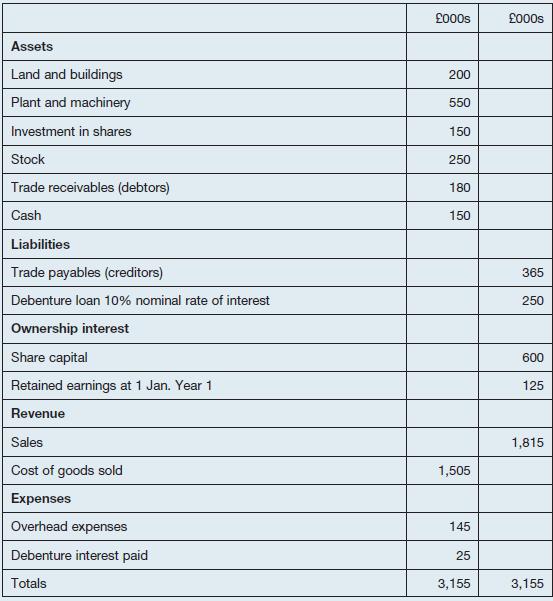

C12.1 Set out below is a summary of the accounting records of Titan Ltd at 31 December

Question:

C12.1 Set out below is a summary of the accounting records of Titan Ltd at 31 December Year 1:

The summary of the accounting records includes all transactions which have been entered in the ledger accounts up to 31 December, but investigation reveals further adjustments which relate to the accounting period up to, and including, that date.

The adjustments required relate to the following matters:

(i) No depreciation has been charged for the year in respect of buildings, plant and machinery.

The depreciation of the building has been calculated as £2,000 per annum and the depreciation of plant and machinery for the year has been calculated as £55,000.

(ii) The company is aware that electricity consumption during the months of November and December, Year 1, amounted to around £5,000 in total, but no electricity bill has yet been received.

(iii) Overhead expenses include insurance premiums of £36,000 which were paid at the start of December, Year 1, in respect of the 12-month period ahead.

(iv) The stock amount is as shown in the accounting records of items moving into and out of stock during the year. On 31 December a check of the physical stock was made. It was discovered that raw materials recorded as having a value of £3,000 were, in fact, unusable.

It was also found that an employee had misappropriated stock worth £5,000.

(v) The company proposes to pay a dividend of £30,000.

(vi) The corporation tax payable in respect of the profits of the year is estimated at £45,000, due for payment on 30 September, Year 2.

Required

(a) Explain how each of the items (i) to (vi) will affect the ownership interest.

(b) Calculate the amount of the ownership interest after taking into account items (i) to (vi).

(Hint: first calculate the profit of the year.)

Step by Step Answer: