Brian Grant set up a business selling quality electrical goods on 1 May 2001. The following represents

Question:

Brian Grant set up a business selling quality electrical goods on 1 May 2001. The following represents the business transactions of the first month.

1. Brian paid £250,000 to the business bank account.

2. He obtained a 10-year business loan of £100,000 from the bank paying the cash into the business bank account.

3. He purchased a fully equipped premises for £600,000. He paid £100,000 in cash and took out a mortgage loan for the balance.

4. Brian bought £550,000 of electrical equipment. He paid £150,000 in cash, the rest being acquired on credit.

5. During the month, Brian sold for £600,000 some electrical goods that had cost

£350,000. The total sales of £600,000 consisted of £150,000 sales on cash and

£450,000 sales on credit.

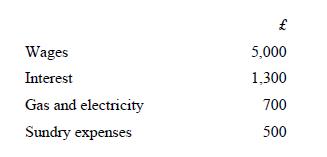

6. At the end of the month, Brian paid the following expenses from his business bank account

7. He decided to depreciate the business premises by 0.1% per month on a straight-line basis.

Required:

(a) Enter these transactions in the accounting equation spreadsheet provided.

(b) Prepare the income statement (profit and loss account) for the month and the statement of financial position (balance sheet) at the end of the month.

(c) Brian is interested to know the main accounting concepts that have been used when drawing up his accounts. Write a short report to explain this to him.

Step by Step Answer: