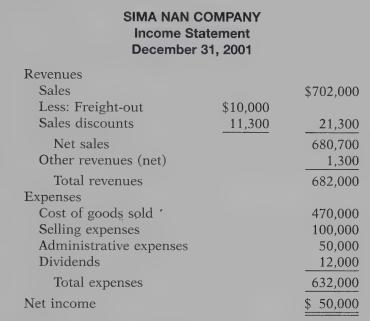

A part-time bookkeeper prepared this income statement for Sima Nan Company for the year ending December 31,

Question:

A part-time bookkeeper prepared this income statement for Sima Nan Company for the year ending December 31, 2001:

As an experienced, knowledgeable accountant, you review the statement and determine the following facts:

1. Sales include $10,000 of deposits from customers for future sales orders.

2. Other revenues contain two items: interest expense $4,000 and interest revenue $5,300.

3. Selling expenses consist of sales salaries $76,000, advertising $10,000, depreciation on store equipment $7,500, and sales commissions expense $6,500.

4. Administrative expenses consist of office salaries $19,000; utilities expense $8,000; rent expense $16,000; and insurance expense $7,000. Insurance expense includes $1,200 of insurance applicable to 2002.

Instructions Prepare a correct detailed multiple-step income statement.

Step by Step Answer:

Financial Accounting Tools For Business Decision Making

ISBN: 9780471347743

2nd Edition

Authors: Paul D. Kimmel, Jerry J. Weygandt, Donald E. Kieso