Jasper Corporation is nearing the end of its first year of operations. Jasper made inventory purchases of

Question:

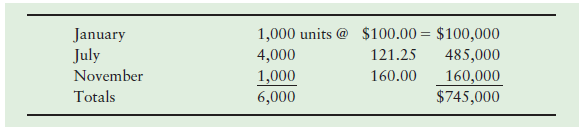

Jasper Corporation is nearing the end of its first year of operations. Jasper made inventory purchases of $745,000 during the year, as follows:

Sales for the year are 5,000 units for $1,200,000 of revenue. Expenses other than cost of goods sold and income taxes total $200,000. The president of the company is undecided about whether to adopt the FIFO method or the LIFO method for inventories. The company’s income tax rate is 40%.

Requirements

1. Prepare income statements for the company under FIFO and under LIFO.

2. Compare the net income under FIFO with the net income under LIFO. Which method produces the higher net income? What causes this difference? Be specific.

CorporationA Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may...

Step by Step Answer:

Financial Accounting

ISBN: 978-0134725987

12th edition

Authors: C. William Thomas, Wendy M. Tietz, Walter T. Harrison Jr.