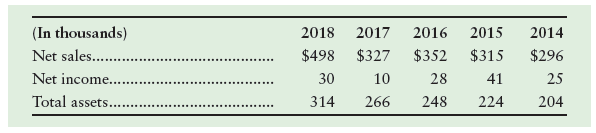

Net sales, net income, and total assets for Azul Shipping, Inc., for a five-year period follow: Requirements

Question:

Net sales, net income, and total assets for Azul Shipping, Inc., for a five-year period follow:

Requirements

1. Calculate trend percentages for each item for 2015 through 2018. Use 2014 as the base year and round to the nearest percent.

2. Calculate the rate of return on net sales for 2016 through 2018, rounding to three decimal places. Explain what this means.

3. Calculate asset turnover for 2016 through 2018. Explain what this means.

4. Use a DuPont Analysis to calculate the rate of return on average total assets (ROA) for 2016 through 2018.

5. How does Azul Shipping’s return on net sales for 2018 compare with previous years? How does it compare with that of the industry? In the shipping industry, rates above 9% are considered good, and rates above 11% are outstanding.

6. Evaluate the company’s ROA for 2018, compared with previous years and against an 18% benchmark for the industry.

Asset TurnoverAsset turnover is sales divided by total assets. Important for comparison over time and to other companies of the same industry. This is a standard business ratio.

Step by Step Answer:

Financial Accounting

ISBN: 978-0134725987

12th edition

Authors: C. William Thomas, Wendy M. Tietz, Walter T. Harrison Jr.