Under Armour, Inc., reports total tax expense of $74,661 (in thousands) on its income statement for year

Question:

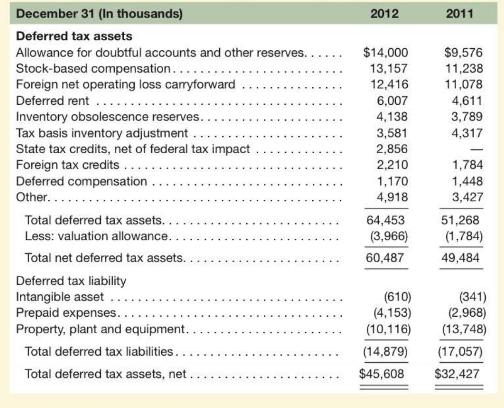

Under Armour, Inc., reports total tax expense of \$74,661 (in thousands) on its income statement for year ended December 31, 2012, and paid cash of \(\$ 57,739\) (in thousands) for taxes. The tax footnote in the company's 10-K filing, reports the following deferred tax assets and liabilities information.

Required

a. Under Armour's deferred tax assets increased during the most recent fiscal year. What explains the increase?

b. Did Under Armour's deferred tax liabilities increase or decrease during the most recent fiscal year? Explain how the change arose.

c. The company's valuation allowance relates to foreign net operating tax losses. Explain how tax losses give rise to deferred tax assets. Why does the company record a valuation account? What proportion of these losses, at December 31, 2012, does the company believe will likely expire unused?

d. Explain how the valuation allowance affected 2012 net income.

\(e\). Use the financial statement effects template to record Under Armour's income tax expense for the fiscal year 2012 along with the changes in both deferred tax assets and liabilities. Assume that the amount needed to balance the tax transaction represents the amount payable to tax authorities.

Step by Step Answer:

Financial And Managerial Accounting For MBAs

ISBN: 9781618533593

6th Edition

Authors: Peter D. Easton