Mercia Corporation is authorized to issue 100,000 shares of common stock and 8,000 shares of preferred stock.

Question:

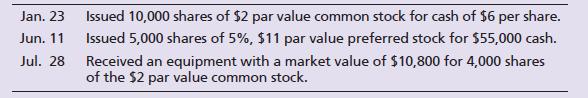

Mercia Corporation is authorized to issue 100,000 shares of common stock and 8,000 shares of preferred stock. During the first year ended 31 December 2024, Mercia Corporation completed the following stock issuance transactions:

Requirement

Journalize the above transactions for Mercia Corporation.

Transcribed Image Text:

Jan. 23 Jun. 11 Jul. 28 Issued 10,000 shares of $2 par value common stock for cash of $6 per share. Issued 5,000 shares of 5%, $11 par value preferred stock for $55,000 cash. Received an equipment with a market value of $10,800 for 4,000 shares of the $2 par value common stock.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 80% (5 reviews)

here are the journal entries for the stock issuance transacti...View the full answer

Answered By

Chandrasekhar Karri

I have tutored students in accounting at the high school and college levels. I have developed strong teaching methods, which allow me to effectively explain complex accounting concepts to students. Additionally, I am committed to helping students reach their academic goals and providing them with the necessary tools to succeed.

0.00

0 Reviews

10+ Question Solved

Related Book For

Horngrens Financial & Managerial Accounting

ISBN: 9780136516255

7th Edition

Authors: Tracie Miller Nobles, Brenda Mattison

Question Posted:

Students also viewed these Business questions

-

The Tusquittee Company is a retail company that began operations on October 1, 2018, when it incorporated in the state of North Carolina. The Tusquittee Company is authorized to issue 100,000 shares...

-

Alpha Corporation is authorized to issue 2,000,000 shares of $3 par value capital stock. The corporation issued half the stock for cash at $8 per share, earned $90,000 during the first three months...

-

TUTOR-MARKED ASSIGNMENT (TMA) This assignment is worth 18% of the final mark for FIN379 Personal Financial Planning. The cut-off date for this assignment is 11 August 2022, 2355hrs. Note to Students:...

-

Amandeep, a graduate of Cambrian Colleges Business Program, found a job as an online marketing specialist for Tangerine Bank. Within a year, he had saved {A} and decided to buy a new car but was not...

-

(a) Using Medtronic as an example, explain how a mission statement gives it a strategic direction. (b) Create a mission statement for your own career.

-

Define and explain the difference between advertising and promotion.

-

Give four reasons why companies will make a product in-house and why they will outsource. LO.1

-

The following items were selected from among the transactions completed by Sherwood Co. during the current year: Mar. 1. Purchased merchandise on account from Kirkwood Co., $225,000, terms n/30. 31....

-

Quillcene Oysteria farms and sells oysters in the Pacific Northwest. The company harvested and sold 7,800 pounds of oysters in August. The company's flexible budget for August appears below. Quileene...

-

Simons Garment Company issued $150,000, 6%, 10-year bond payable. Assume that the accounting year of Simons Garment Company ends on December 31. Journalize the following transactions for Simons...

-

Match solutions and differential equations. (a) (b) (c) (d) (e) aaaaa dx dy - 32 = dx X dy dx dy y x dx dy dx = 3x = y 3y (1) y = x (II) y = 3x (III) y = ex (IV) y = 3e* (V) y = x

-

In the following molecule, atoms X and Y are from the same period, meaning they are approximately the same size. The difference in the size of the spheres indicates a difference in the amount of time...

-

reflective account of your development as a postgraduate learner since joining SBS considering the points below. Critically reflect on one or more points below: Assessment Criteria Use a reflective...

-

Technology, strategy, size, and environment are among the factors that influence leaders' choice of organization structure (Schulman, 2020). The leaders must consider the technology to be used in the...

-

6. Answer the following briefly. a.What is the metric and its hurdle rate for an "Enterprise" to increase its enterprise value? b.What is the metric and its hurdle rate for the corporation's equity...

-

Name the two major preceding management theories that contributed to the development of quality management theory. Briefly explain the major concepts of each of these preceding theories that were...

-

922-19x 8 After finding the partial fraction decomposition. (22 + 4)(x-4) dx = dz Notice you are NOT antidifferentiating...just give the decomposition. x+6 Integrate -dx. x33x The partial fraction...

-

Paul suffers from emphysema and severe allergies and, upon the recommendation of his physician, has a dust elimination system installed in his personal residence. In connection with the system, Paul...

-

1. Following are information about Alhadaf Co. Cost incurred Inventory Purchases Sales Adverting expense Salary Expense Depreciation Beginning Inventory Ending Inventory Amount 118,000 350.000 90,000...

-

As the director of the multistate tax planning department of a consulting firm, you are developing a brochure to highlight the services it can provide. Part of the brochure is a list of five or so...

-

Castle Corporation conducts business in States 1, 2, and 3. Castle's $630,000 taxable income consists of $555,000 apportionable income and $75,000 allocable income generated from transactions...

-

Complete the following chart by indicating whether each item is true or false. Explain your answers by referencing the overlap of rules appearing in Federal and most state income tax laws. True or...

-

Saly paid $52,000 a year paid on a weekly basis. last pay she had $250 withheld in Income Tax, $48.97 for CPP and $15.80 for EI. an additional $and 25.00 in tax are deducted each pay. She allowed to...

-

Required information [The following information applies to the questions displayed below.] Dain's Diamond Bit Drilling purchased the following assets this year. Asset Drill bits (5-year) Drill bits...

-

Which of the following partnership items are not included in the self-employment income calculation? Ordinary income. Section 179 expense. Guaranteed payments. Gain on the sale of partnership...

Study smarter with the SolutionInn App