The general ledger of International Consulting Services at June 30, 2025, the end of the companys fiscal

Question:

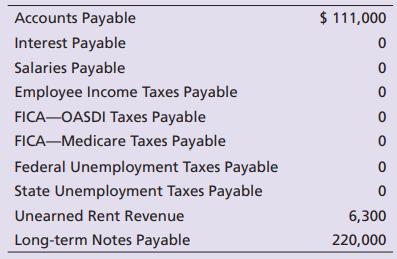

The general ledger of International Consulting Services at June 30, 2025, the end of the company’s fiscal year, includes the following account balances before payroll and adjusting entries.

The additional data needed to develop the payroll and adjusting entries at June 30 are as follows:

a. The long-term debt is payable in annual installments of $44,000, with the next installment due on July 31. On that date, International Consulting Services will also pay one year’s interest at 10%. Interest was paid on July 31 of the preceding year. Make the adjusting entry to accrue interest expense at year-end.

b. Gross unpaid salaries for the last payroll of the fiscal year were $4,900. Assume that employee income taxes withheld are $960 and that all earnings are subject to OASDI.

c. Record the associated employer taxes payable for the last payroll of the fiscal year, $4,900. Assume that the earnings are not subject to unemployment compensation taxes.

d. On February 1, the company collected one year’s rent of $6,300 in advance.

Requirements

1. Journalize the June 30 payroll and adjusting entries. Identify each adjusting entry by letter. Round to the nearest dollar.

2. Using T-accounts, open the listed accounts with the unadjusted June 30 balances. Post the June 30 payroll and adjusting entries, from Requirement 1. Identify each adjusting entry by letter.

3. Prepare the current liabilities section of the balance sheet at June 30, 2025.

Step by Step Answer:

Horngrens Financial And Managerial Accounting The Financial Chapters

ISBN: 9780137858651

8th Edition

Authors: Tracie Miller Nobles, Brenda Mattison