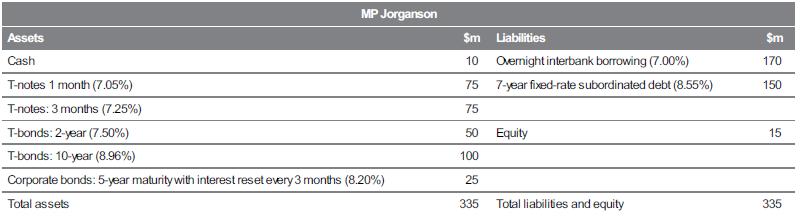

1.Use the following information about a hypothetical government security dealer named MP Jorganson to answer parts (a)...

Question:

1.Use the following information about a hypothetical government security dealer named MP Jorganson to answer parts

(a) to (e). (Market yields are in parentheses.)

What is the repricing or funding gap if the planning period is 30 days? 91 days? Two years? (Recall that cash is a non-interest-earning asset.)

What is the impact over the next 30 days on net interest income if all interest rates rise by 50 basis points?

If the duration of assets is 3.41 years and the duration of liabilities is 3.5 years, what is MP Jorganson’s duration gap?

What conclusions regarding MP Jorganson’s interest rate risk exposure can you draw from the duration gap in your answer to question (c)? From the repricing or funding gap (30 days’ planning period) in your answer to question (a)?

e Approximately how will the market value of the Treasury Note portfolio change if all interest rates increase by 50 basis points? LO 5.3, 5.4

Step by Step Answer:

Financial Institutions Management A Risk Management

ISBN: 9781743073551

4th Edition

Authors: Helen Lange, Anthony Saunders, Marcia Millon Cornett