31. Problem 23 in Chapter 8 concerned the Rollins Metal Company, which is engaged in long-term planning.

Question:

31. Problem 23 in Chapter 8 concerned the Rollins Metal Company, which is engaged in long-term planning. The firm is trying to choose among several strategic options that imply different future growth rates and risk levels. Reread that problem on pages 366–367 now.

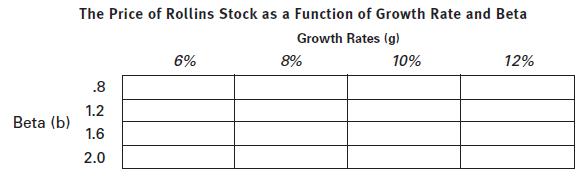

The CAPM gives some additional insight into the relation between risk and required return. We can now define risk as beta, and evaluate its effect on stock price by constructing a chart similar to the one called for in Problem 23 of Chapter 8, replacing k on the left side with beta (b).

Rollins’s beta calculated from historical data is .8. However, the risky strategies being considered could influence that figure significantly. Management feels beta could rise to as much as 2.0 under certain strategic options. Treasury bills currently yield 3%, while the S&P index is showing a return of 8%. Recall that Rollins’s last dividend was $2.35.

a. Use the CAPMVAL program to construct the following chart.

b. The effect of beta on required return and price is influenced by the general level of risk aversion, which in the CAPM is represented by (kM kRF), which is also the market risk premium and the slope of the SML. In part

(a) of this problem the market risk premium is (8% 3% ) 5%. Economists, however, predict a recession that could sharply increase risk aversion. Reconstruct the chart above assuming the market risk premium increases to 7% (kM rises to 10% with no change in kRF).

c. Do your charts give any new insights into the risk-return-growth relationship?

(i.e., how does the reward for bearing more risk in terms of stock price change in recessionary times?) Write the implied required return on your charts next to the values of beta. Then compare the charts with the one from Problem 23 of Chapter 8.

d. Does the inclusion of beta and the CAPM really make management’s planning job any less intuitive? In other words, is it any easier to associate a strategy’s risk level with a beta than directly with a required return?

Step by Step Answer: