6. Sanville Quarries is considering acquiring a new drilling machine that is expected to be more efficient

Question:

6. Sanville Quarries is considering acquiring a new drilling machine that is expected to be more efficient than the current machine. The project is to be evaluated over four years. The initial outlay required to get the new machine operating is

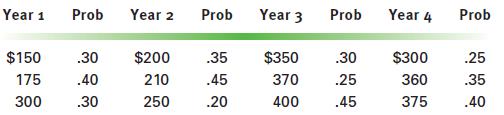

$675,000. Incremental cash flows associated with the machine are uncertain, so management developed the following probabilistic forecast of cash flows by year

($000). Sanville’s cost of capital is 10%.

a. Calculate the project’s best and worst NPV’s and their probabilities.

b. What are the value and probability of the most likely NPV outcome?

c. Sketch the results of

(a) and

(b) on a probability distribution.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: