8. Bensons Markets is a five-store regional supermarket chain that has done very well by using modern

Question:

8. Benson’s Markets is a five-store regional supermarket chain that has done very well by using modern management and distribution techniques. Benson competes with Foodland Inc., a larger chain with 10 stores. However, Foodland has not kept pace with technological and merchandising developments, and has been losing money lately. Foodland’s owners are interested in retiring and have approached Benson’s with a proposal to sell the chain for $50 million.

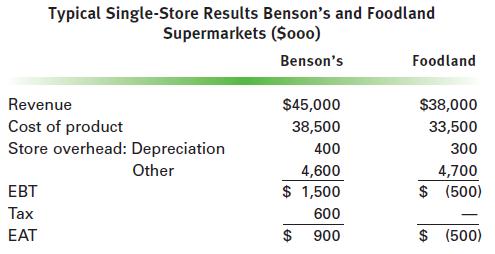

Within each chain, individual stores perform uniformly. Typical results for an average store in each company are as follows.

If Benson were to make the acquisition, it would immediately close three of Foodland’s stores that are located close to its own markets and sell the buildings for about $1 million each. The remaining stores would operate at their current loss levels for about two years, during which time they would be upgraded to Benson’s operating standards. The upgrades would cost $3 million per store, spread over the first two years. After that, the acquired stores would have about the same operating performance as Benson’s other stores. Benson’s CFO feels that a discount rate of 12% is appropriate for the risk associated with the proposition.

Benson’s marginal tax rate is 40%.

a. Calculate the value of the acquisition to Benson’s, assuming there is no impact on any of Benson’s five original stores. Assume that the incremental cash flow from the acquired stores goes on forever but does not grow. Should Benson pay Foodland’s price? If not, does the deal look good enough to negotiate for a better price? What is the most Benson should be willing to pay?

b. (No calculations—just ideas.) Are there reasons beyond the calculations in part

(a) that argue in favor of the acquisition? (Hint: Think along two lines about the competitive situation. First, what will happen if Benson doesn’t buy Foodland? Second, what effect will the acquisition have on Benson’s existing stores?)

c. Could the ideas in part

(b) be quantified into adjustments to the results in part (a)? Make your own estimate of the impact of such ideas on the price Benson should be willing to pay.

Step by Step Answer: