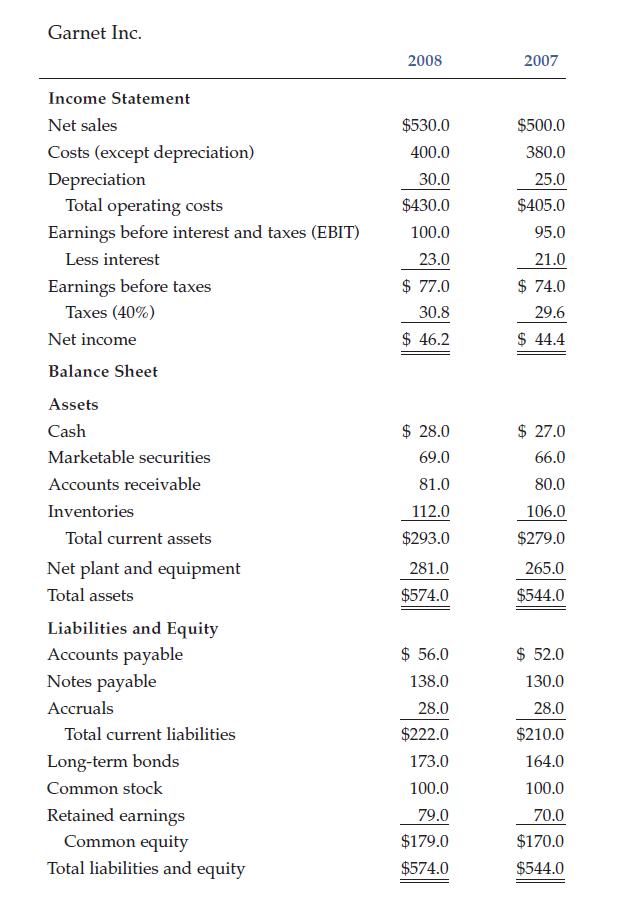

Use the following income statements and balance sheets to calculate Garnet Inc.s free cash flow for 2008.

Question:

Use the following income statements and balance sheets to calculate Garnet Inc.’s free cash flow for 2008.

Transcribed Image Text:

Garnet Inc. Income Statement Net sales Costs (except depreciation) Depreciation Total operating costs Earnings before interest and taxes (EBIT) Less interest Earnings before taxes Taxes (40%) Net income Balance Sheet Assets Cash Marketable securities Accounts receivable Inventories Total current assets Net plant and equipment Total assets Liabilities and Equity Accounts payable Notes payable Accruals Total current liabilities Long-term bonds Common stock Retained earnings Common equity Total liabilities and equity 2008 $530.0 400.0 30.0 $430.0 100.0 23.0 $77.0 30.8 $ 46.2 $ 28.0 69.0 81.0 112.0 $293.0 281.0 $574.0 $ 56.0 138.0 28.0 $222.0 173.0 100.0 79.0 $179.0 $574.0 2007 $500.0 380.0 25.0 $405.0 95.0 21.0 $74.0 29.6 $ 44.4 $ 27.0 66.0 80.0 106.0 $279.0 265.0 $544.0 $ 52.0 130.0 28.0 $210.0 164.0 100.0 70.0 $170.0 $544.0

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 16% (6 reviews)

To calculate Garnet Incs free cash flow for 2008 we need to follow this ...View the full answer

Answered By

PALASH JHANWAR

I am a Chartered Accountant with AIR 45 in CA - IPCC. I am a Merit Holder ( B.Com ). The following is my educational details.

PLEASE ACCESS MY RESUME FROM THE FOLLOWING LINK: https://drive.google.com/file/d/1hYR1uch-ff6MRC_cDB07K6VqY9kQ3SFL/view?usp=sharing

3.80+

3+ Reviews

10+ Question Solved

Related Book For

Financial Management Theory & Practice

ISBN: 9780324652178

12th Edition

Authors: Eugene BrighamMichael Ehrhardt

Question Posted:

Students also viewed these Business questions

-

Use the following income statements and balance sheets to calculate Garnet Inc.'s free cash flow for 2012. Garnet Inc. 2013 2012 Income Statement (Millions of Dollars) Net sales Costs (except...

-

Use the following income statements and balance sheets to calculate Garnet Inc.'s free cash flow for 2011. GarnetInc. Income State ment 2011 2010 $500,0 Net sales $530.0 Costs (except depreciation)...

-

Use the following income statements and balance sheets to calculate Garnet Inc.'s free cash flow for 2005. Garnet Inc. 2004 2005 INCOME STATEMENT Net sales $530.0 $500.0 Costs (except depreciation)...

-

A study of 876 senior citizens shows that participants who exercise regularly exhibit less of a decline in cognitive ability than those who barely exercise at all. From this study, a researcher...

-

Suppose you have announced you will meet the competition in response to entry threats by a potential rival who has done marketing research in your target market and is offering a lower price point....

-

The following data are for 30 observations involving two qualitative variables, x and y. The categories for x are A, B, and C; the categories for y are 1 and 2. a. Develop a crosstabulation for the...

-

Sound waves from a basketball. Refer to the American Journal of Physics (June 2010) study of sound waves in a spherical cavity, Exercise 11.31 (p. 629). You fit a straight-line model relating sound...

-

Identify the key challenges that the Big Four firms will likely face in their efforts to establish a major presence in the Islamic banking industry.

-

QS 18-12 Direct materials used P2 Use the following information to compute the cost of direct materials used for the current year. Assume the Raw Materials Inventory account is used only for direct...

-

The Rogers Company is currently in this situation: (1) EBIT = $4.7 million; (2) tax rate, T = 40%; (3) value of debt, D = $2 million; (4) r d = 10%; (5) r s = 15%; (6) shares of stock outstanding, n...

-

Ewald Companys current stock price is $36, and its last dividend was $2.40. In view of Ewalds strong financial position and its consequent low risk, its required rate of return is only 12%. If...

-

Which legal structure is most difficult to establish and why?

-

1. Consider the following economy: C = 3, I = 1.5, G = 2.65, T = 2, f = 0.5, d = 0.1, a = 0.8 a) Write the mathematical expression of the consumption function b) Write the mathematical expression of...

-

Question 2 (Financial statement Analysis) Following is a comparative statement of financial position for Sam's Company: Sam's Company Comparative Statement of Financial Position December 31, 2020 and...

-

Q4. Johnny's Burger is a family-run fast food joint. In addition to its famous hamburger, Johnny's Burger has just launched a new "Organic Beef burger. The owner, Johnny, would like to know if his...

-

Compute ScholarPak's break-even point in sales dollars for the year. 2. Compute the number of sales units required to earn a net income of $540,000 during the year. 3. ScholarPak's variable...

-

41-44 Find fogoh. 41. f(x)=3x-2, g(x) = sin x, 42. f(x)=|x4|, g(x) = 2, 43. f(x)=x-3, g(x) = x, h(x) = x h(x) = x h(x) = x + 2 44. f(x) = tan x, g(x) == X x-1' h(x) = x

-

Royal Corporation is closing one of its divisions. The division has sales of $120,000, direct manufacturing costs of $100,000, and manufacturing overheads of $40,000 (75% fixed). The fixed...

-

Chao, Louis, and Mari, unrelated individuals, own all of the shares of Cerise Corporation. All three shareholders have been active in the management of Cerise since its inception. In the current...

-

Can the kind of care proposed in an IDS be provided in a system that has a primary focus on either provider or corporate incomes and profit accumulation?

-

Discuss three of the CMS's major value-based programs. Define the programs and the criteria that are needed for each of these programs to be successful.

-

Choose two preferred financial and patient care outcomes from the following list and describe two ways to achieve each of them: a. Reduce overall hospital admissions. b. Reduce average length of...

-

Break-Even Sales and Sales to Realize Income from Operations For the current year ending October 31, Yentling Company expects fixed costs of $537,600, a unit variable cost of $50, and a unit selling...

-

You buy a stock for $35 per share. One year later you receive a dividend of $3.50 per share and sell the stock for $30 per share. What is your total rate of return on this investment? What is your...

-

Filippucci Company used a budgeted indirect-cost rate for its manufacturing operations, the amount allocated ($200,000) is different from the actual amount incurred ($225,000). Ending balances in the...

Study smarter with the SolutionInn App