Complete the following table. Assume a bond with a $1,000 par value, 10-year maturity that pays interest

Question:

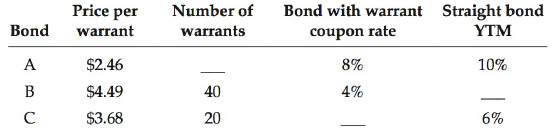

Complete the following table. Assume a bond with a $1,000 par value, 10-year maturity that pays interest annually.

Maturity is the date on which the life of a transaction or financial instrument ends, after which it must either be renewed, or it will cease to exist. The term is commonly used for deposits, foreign exchange spot, and forward transactions, interest...

Number of warrants Price per warrant Bond with warrant Straight bond coupon rate Bond YTM A $2.46 8% 10% 4% 40 $4.49 $3.68 20 6%

Step by Step Answer:

Bond A N 10 PMT 80 FV 1000 I 10 and solve for PV 87711 ...View the full answer

Financial Management Theory And Practice

ISBN: 978-0176583057

3rd Canadian Edition

Authors: Eugene Brigham, Michael Ehrhardt, Jerome Gessaroli, Richard Nason

Related Video

Bond valuation is the process of determining the worth of a bond. It is based on the present value of the bond\'s future cash flows, which include coupon payments and the return of the bond\'s face value (or \"principal\") at maturity. The discount rate used in the calculation is directly tied to prevailing interest rates, and a rise in interest rates will decrease the present value of the bond and thus lower its price. Conversely, a fall in interest rates will increase the present value of the bond and raise its price. Interest rates serve as a benchmark for determining the value of a bond, as they determine the discount rate used in the bond valuation calculation. The most commonly used measure of interest rates is the yield to maturity (YTM), which represents the internal rate of return of an investment in a bond if the investor holds the bond until maturity and receives all scheduled payments. Yield to maturity is a function of the coupon rate, the current market price of the bond, the face value of the bond, and the number of years remaining until maturity. By comparing the yield to maturity of a bond to prevailing market interest rates, an investor can assess the relative value of the bond.

Students also viewed these Business questions

-

Tsetsekos Company was planning to finance an expansion. The principal executives of the company all agreed that an industrial company such as theirs should finance growth by means of common stock...

-

Griswall Industries sells on terms of 2/10, net 30. Total sales for the year are $1,460,000. Thirty percent of the customers pay on the 10th day and take discounts; the other 70% pay, on average, 40...

-

Assume that you have been given the following information on Purcell Industries: Current stock price = $25 Time to maturity of option = 6 months Variance of stock return = 0.09 d 1 = 0.2239 d 2 =...

-

Consider the following scenario. Each day, a butcher buys a 200-kilogram pig for $360. The pig can be processed to yield the following three products: Day 1 The butcher buys a pig. The $360 joint...

-

Let 0(x) denote the 5-spline function of Exercise 11.4.23. Assuming n > 4, let P" denote the vector space of periodic cubic splines based on the integer nodes xj = j for j = 0,... , n. (a) Prove that...

-

REQUIRED: Cost of production report under the following assumptions: Lost units - normal, discovered at the beginning Lost units - normal, discovered at the end Lost units - abnormal, discovered when...

-

Describe the home-buying process.? lo1

-

The financial statements at the end of Miramar, Inc.'s first month of operation are shown below. By analyzing the interrelationships among the financial statements, fill in the proper amounts for (a)...

-

An individual has $ 3 5 , 0 0 0 invested in a stock with a beta of 0 . 4 and another $ 6 5 , 0 0 0 invested in a stock with a beta of 1 . 1 . If these are the only two investments in her portfolio,...

-

Proud Corporation acquired 80 percent of Stergis Companys voting stock on January 1, 20X3, at underlying book value. The fair value of the noncontrolling interest was equal to 20 percent of the book...

-

Fisher Investments recently issued convertible bonds with a $1,000 par value. The bonds have a conversion price of $50 a share. What is the convertible issue's conversion ratio?

-

The table below provides market data from October 1, 2014, Solve for the unknown variables. The "Premium" column refers to the percentage extra an investor would pay for the stock if it purchased the...

-

A hot-water tank of cylindrical shape has an inside diameter of 0.55 m and inside height of 1.2 m. The tank is enclosed with a 5-cm-thick insulating layer of glass wool whose thermal conductivity is...

-

Use your understanding of work and power to answer the following questions. 1. Two physics students, Will N. Andable and Ben Pumpiniron, are in the weightlifting room. Will lifts the 100-pound...

-

Problem 2. Consider the following chemical reaction. 2H2 + O2 = 2HO Gibbs Duhem equation states that SdT - Vdp+ Nidi=0. Apply this equation for the above reaction and determine the equilibrium...

-

Part D: Exploring Pascal's Triangle 1. Fill-In the missing numbers in Pascal's Triangle. See 2. Find the sum of each row in Pascal's Triangle. Describe the pattern. 1, 2, 4, 8, 16... Power of 2n 1 1...

-

A new partner C is invited to join in the AB partnership. Currently, A's and B's capital are $540,000 and $100,000, respectively. According to their profit and loss sharing contract, partner A and B...

-

The two tanks shown are connect through a mercury manometer. What is the relation between ???? and ? water Az water Ah

-

For the following exercises, let F(x) = (x + 1) 5 , f(x) = x 5 , and g(x) = x + 1. (f g)(6); ( g f)(6)

-

Derive Eq. (18.33) from Eq. (18.32).

-

The following equation can, under certain assumptions, be used to forecast financial requirements: Under what conditions does the equation give satisfactory predictions, and when should it not be...

-

Suppose a firm makes the following policy changes. If the change means that external, non-spontaneous financial requirements (AFN) will increase, indicate this by a (=); indicate a decrease by a (=);...

-

AFN equation Carter Corporation's sales are expected to increase from $5 million in 2005 to $6 million in 2006, or by 20 percent. Its assets totaled $3 million at the end of 2005. Carter is at full...

-

An 8%, 30-year semi-annual corporate bond was recently being priced to yield 10%. The Macaulay duration for this bond is 10.2 years. What is the bonds modified duration? How much will the price of...

-

Question 7 of 7 0/14 W PIERDERY Current Attempt in Progress Your answer is incorrect Buffalo Corporation adopted the dollar value LIFO retail inventory method on January 1, 2019. At that time the...

-

Cost of debt with fees . Kenny Enterprises will issue a bond with a par value of $1,000, a maturity of twenty years, and a coupon rate of 9.9% with semiannual payments, and will use an investment...

Study smarter with the SolutionInn App