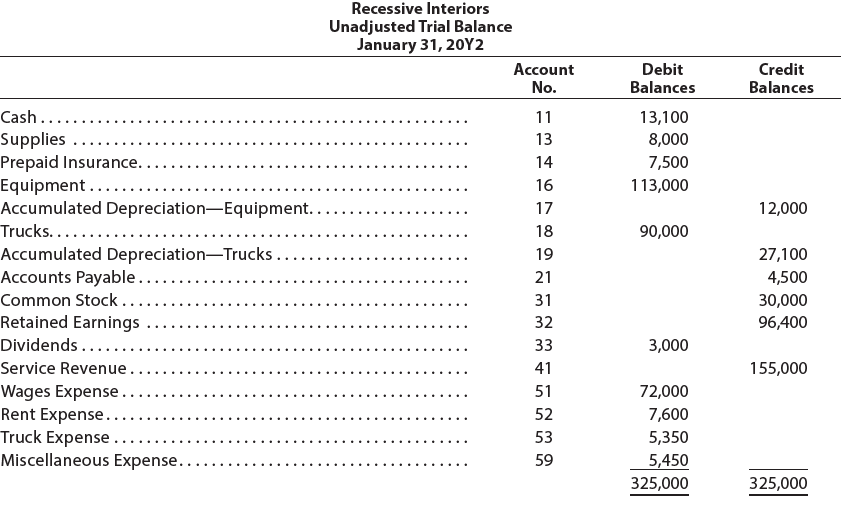

The unadjusted trial balance of Recessive Interiors at January 31, 20Y2, the end of the year, follows:

Question:

The unadjusted trial balance of Recessive Interiors at January 31, 20Y2, the end of the year, follows:

The data needed to determine year-end adjustments are as follows:

(a) Supplies on hand at January 31 are $2,850.

(b) Insurance premiums expired during the year are $3,150.

(c) Depreciation of equipment during the year is $5,250.

(d) Depreciation of trucks during the year is $4,000.

(e) Wages accrued but not paid at January 31 are $900.

Instructions

1. For each account listed in the unadjusted trial balance, enter the balance in the appropriate Balance column of a four-column account and place a check mark () in the Posting Reference column.

2. (Optional) Enter the unadjusted trial balance on an end-of-period spreadsheet and complete the spreadsheet. Add the accounts listed in part (3) as needed.

3. Journalize and post the adjusting entries, inserting balances in the accounts affected. Record the adjusting entries on Page 26 of the journal. The following additional accounts from Recessive Interiors’ chart of accounts should be used: Wages Payable, 22; Depreciation Expense—Equipment, 54; Supplies Expense, 55; Depreciation Expense—Trucks, 56; Insurance Expense, 57.

4. Prepare an adjusted trial balance.

5. Prepare an income statement, a statement of stockholders’ equity, and a balance sheet. During the year ended January 31, 20Y2, additional common stock of $7,500 was issued.

6. Journalize and post the closing entries. Record the closing entries on Page 27 of the journal. Indicate closed accounts by inserting a line in both Balance columns opposite the closing entry.

7. Prepare a post-closing trial balance.

Step by Step Answer:

Forensic And Investigative Accounting

ISBN: 9780808056300

10th Edition

Authors: G. Stevenson Smith D. Larry Crumbley, Edmund D. Fenton