Futures contracts that are sensitive to interest rates may be used as hedging instruments against interest rate

Question:

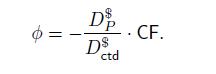

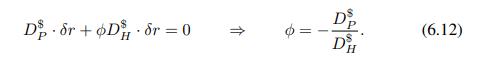

Futures contracts that are sensitive to interest rates may be used as hedging instruments against interest rate risk. However, if we use bond futures, a complication arises, as we should consider the duration \(D_{\text {ctd }}^{\$}\) of the bond that is likely to be actually delivered (the cheapest-to-deliver bond that we mentioned in Section 5.3.2) as well as its conversion factor CF. In this case, Eq. (6.12) reads

Using euro dollar futures or similar contracts avoids this trouble. In any case, hedging over a long time horizon using future contracts may require tailing the hedge, in order to account for daily markingto-market.

Data From Equation (6.12)

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

An Introduction To Financial Markets A Quantitative Approach

ISBN: 9781118014776

1st Edition

Authors: Paolo Brandimarte

Question Posted: