Nelson Inc. purchased machinery at the beginning of 2008 for ($90,000). Management used the straight-line method to

Question:

Nelson Inc. purchased machinery at the beginning of 2008 for \($90,000\). Management used the straight-line method to depreciate the cost for financial reporting purposes and the sumof-

the-years’-digits method to depreciate the cost for tax purposes. The life of the machinery was estimated to be two years, and the salvage value was estimated at zero. Revenues less expenses other than depreciation expense and goodwill impairment equaled \($500,000\) for 2008 and 2009. Nelson pays income tax at the rate of 20% of taxable income. The goodwill impairment equaled \($50,000\) for 2008 and 2009.

Required:

1. Compute the taxable income and the financial reporting income (before tax) for the years 2008 and 2009.

2. What are the permanent and timing differences? Give an example of each for Nelson.

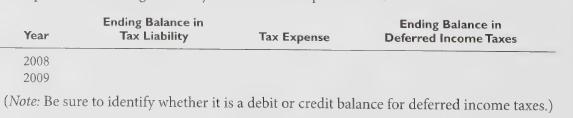

3. Complete the following table on your answer to requirement 1.

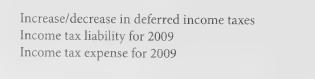

Assume that the federal government changes the tax rate to 30% at the beginning of 2009.

Compute the following:

Step by Step Answer: