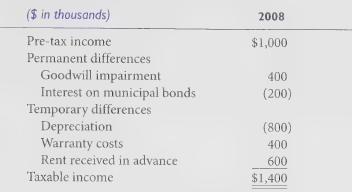

Metge Corporation's worksheet for calculating taxable income for 2008 follows: The enacted tax rate for 2008 is

Question:

Metge Corporation's worksheet for calculating taxable income for 2008 follows:

The enacted tax rate for 2008 is 35%, but it is scheduled to increase to 40% in 2009 and subsequent years. All temporary differences are originating differences.

Required:

1. Determine Metge's 2008 taxes payable.

2 . What is the change in deferred tax assets (liabilities) for 2008?

3. Determine tax expense for 2008.

4 . Provide a schedule that reconciles Metge’s statutory and effective tax rates (in both percentages and dollar amounts).

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: