Smith Corporation started doing business in 2007. The following table summarizes the companys taxable income (loss) over

Question:

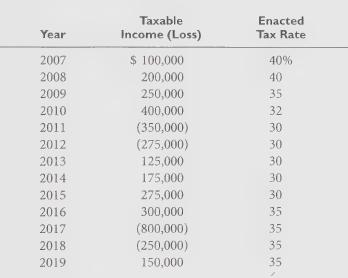

Smith Corporation started doing business in 2007. The following table summarizes the company’s taxable income (loss) over the 2007-2019 period and the statutory tax rate effective in each year:

Because Smith had no permanent or timing differences during this period, its pre-tax financial reporting income was identical to its taxable income in each year. During the 2016-2019 period, Smith expected the current and future tax rates to be 35%. When possible, the company took advantage of the loss carryback provision of the tax law. When recording the tax benefits of the loss carryforward provision, management believed it was more likely than not that the tax benefits would be fully realized.

Required:

1. Provide journal entries to record income tax expense for the years 2011, 2012, 2017, 2018 and 2019.

2. In answering this requirement, make the following assumptions. During 2017 and 2018, Smith management believed it was more likely than not that only 40% of the tax benefits would be realized through a loss carryforward. However, during 2019, the company revised its expectation, believing that it was more likely than not that 100% of the tax benefits would be fully realized through a loss carryforward. Provide journal entries to record income tax expense for the years 2017, 2018, and 2019. Also show how to report the deferred tax asset as of the end of 2017, 2018, and 2019.

Step by Step Answer: