Based on Byrons forecast, if NinMount deems it has acquired control of Boswell, Nin-Mounts consolidated 2009 depreciation

Question:

Based on Byron’s forecast, if NinMount deems it has acquired control of Boswell, Nin-Mount’s consolidated 2009 depreciation and amortization expense (in £ millions) will be closest to:

A. 102.

B. 148.

C. 204.

Percy Byron, CFA, is an equity analyst with a UK-based investment firm. One firm Byron follows is NinMount PLC, a UK-based company. On 31 December 2008, NinMount paid £320 million to purchase a 50 percent stake in Boswell Company. The excess of the purchase price over the fair value of Boswell’s net assets was attributable to previously unrecorded licenses.

These licenses were estimated to have an economic life of six years. The fair value of Boswell’s assets and liabilities other than licenses was equal to their recorded book values. NinMount and Boswell both use the pound sterling as their reporting currency and prepare their financial statements in accordance with IFRS.

Byron is concerned whether the investment should affect his “buy” rating on NinMount common stock. He knows NinMount could choose one of several accounting methods to report the results of its investment, but NinMount has not announced which method it will use. Byron forecasts that both companies’ 2009 financial results (excluding any merger accounting adjustments) will be identical to those of 2008.

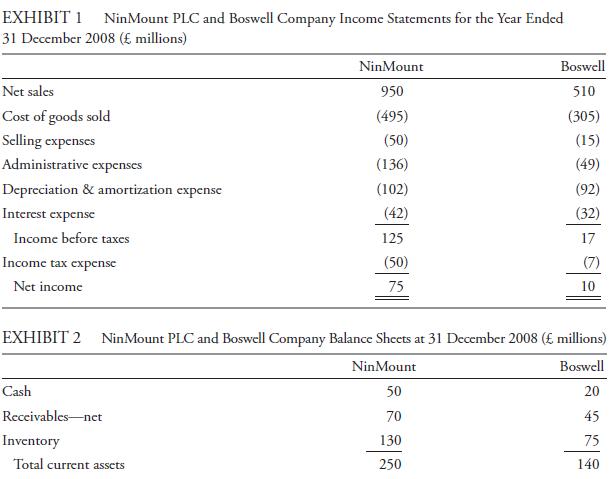

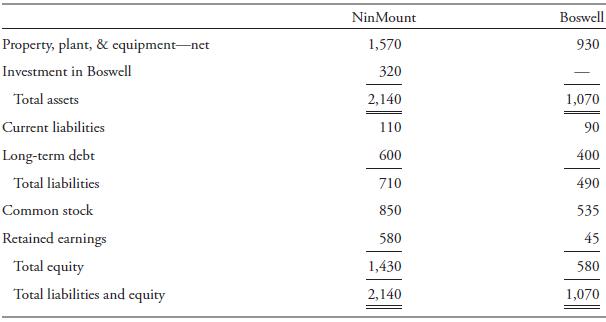

NinMount’s and Boswell’s condensed income statements for the year ended 31 December 2008, and condensed balance sheets at 31 December 2008, are presented in Exhibits 1 and 2, respectively.

Step by Step Answer:

International Financial Statement Analysis CFA Institute Investment Series

ISBN: 9780470287668

1st Edition

Authors: Thomas R. Robinson, Hennie Van Greuning CFA, Elaine Henry, Michael A. Broihahn, Sir David Tweedie