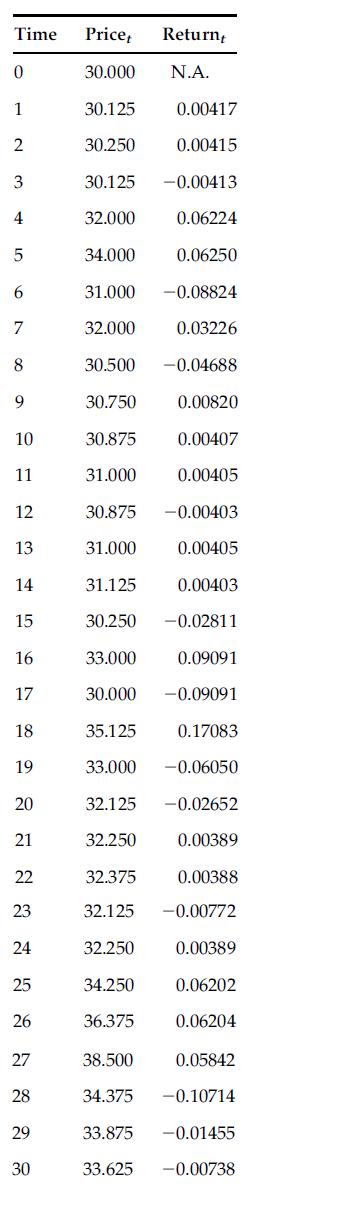

The following table presents sample daily historical price data for a stock whose returns are given in

Question:

The following table presents sample daily historical price data for a stock whose returns are given in the third column.

a. Based on a traditional sample estimator, calculate a daily variance estimator for this stock.

b. Assume that returns follow a Brownian motion process (at least that stock returns are uncorrelated over time) and that there are 30 trading days per month. What would be the monthly variance for this stock?

c. What would be the Parkinson extreme value estimated daily returns variance for this stock?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: