Referring to the previous problem, Mr. Backster is likely to hold the apartment complex of his choice

Question:

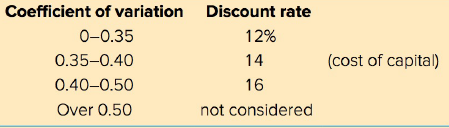

a. Compute the risk-adjusted net present value for Windy Acres and Hillcrest Apartments using cash flow figures from the previous problem.

b. Which investment should Mr. Backster accept if the two investments are mutually exclusive? If the investments are not mutually exclusive and no capital rationing is involved, how would your decision be affected?

What is NPV? The net present value is an important tool for capital budgeting decision to assess that an investment in a project is worthwhile or not? The net present value of a project is calculated before taking up the investment decision at... Capital Rationing

Capital rationing is the act of placing restrictions on the amount of new investments or projects undertaken by a company. Capital rationing is the decision process used to select capital projects when there is a limited amount of funding available....

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Foundations of Financial Management

ISBN: 978-1259024979

10th Canadian edition

Authors: Stanley Block, Geoffrey Hirt, Bartley Danielsen, Doug Short, Michael Perretta

Question Posted: