10 Comparing degrees of translation exposure. Nelson Ltd is a UK firm with annual export sales to...

Question:

10 Comparing degrees of translation exposure.

Nelson Ltd is a UK firm with annual export sales to Singapore of about £20 million. Its main competitor is Hamilton Ltd, also based in the United Kingdom, with a subsidiary in Singapore that also generates about

£20 million in annual sales. Any earnings generated by the subsidiary are reinvested to support its operations.

Based on the information provided, which firm is subject to a higher degree of translation exposure?

Explain.

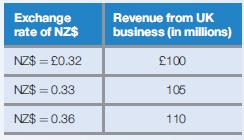

a St Paul’s UK sales are somewhat affected by the value of the New Zealand dollar (NZ$), because it faces competition from New Zealand exporters. It forecasts the UK sales based on the following three exchange rate scenarios:

b Its New Zealand dollar revenues on sales to New Zealand invoiced in New Zealand dollars are expected to be NZ$600 million.

c Its anticipated cost of goods sold is estimated at £200 million from the purchase of UK materials and NZ$100 million from the purchase of New Zealand materials.

d Fixed operating expenses are estimated at £30 million.

e Variable operating expenses are approximated as 20% of total sales (after including New Zealand sales, translated to a pound amount).

f Interest expense is estimated at £20 million on existing UK loans, and the company has no existing New Zealand loans.

Create a forecasted income statement for St Paul under each of the three exchange rate scenarios.

Explain how St Paul’s projected earnings before taxes are affected by possible exchange rate movements.

Explain how it can restructure its operations to reduce the sensitivity of its earnings to exchange rate movements without reducing its volume of business in New Zealand.

Step by Step Answer: