Bryon Ltd has held 1,500,000 shares in Carlyle Ltd for many years. At the date of acquisition,

Question:

Bryon Ltd has held 1,500,000 shares in Carlyle Ltd for many years. At the date of acquisition, the reserves of Carlyle Ltd amounted to £800,000. On 31 March 2006 Carlyle Ltd bought 400,000 shares in Doyle Ltd for £600,000 and a further 400,000 shares were purchased on 30 June 2006 for £650,000.

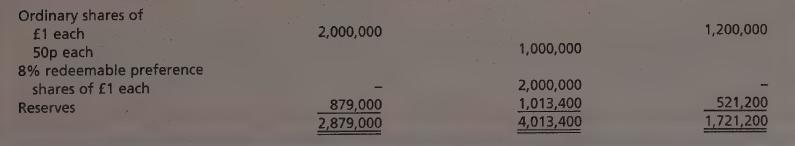

At 30 September 2006 the balance sheets of the three companies were:

Dividends on the preference shares were paid for one-half year on 1 April 2006; the next payment date was 1 October 2006.

Profits for the year in Doyle Ltd were £310,000 before making any adjustments for consolidation, accruing evenly through the year.

The directors of Bryon Ltd consider that the assets and liabilities of Carlyle Ltd are shown at fair values, but fair values for Doyle Ltd for the purposes of consolidation are:

Other assets and liabilities are considered to be at fair values in the balance sheet.

Additional depreciation due to the revaluation of the plant and equipment in Doyle Ltd amounts to £40,000 for the year to 30 September 2006.

Included in stocks in Carlyle Ltd are items purchased from Doyle Ltd during the last three months of the year, on which Doyle Ltd recorded a profit of £80,000.

On 30 September 2006 Carlyle Ltd drew a cheque for £100,000 and sent it to Doyle Ltd to clear the current account. As this cheque was not received by Doyle Ltd until 3 October, no account was taken of it in the Doyle Ltd balance sheet.

Required:

Prepare a balance sheet as at 30 September 2006 for Bryon Ltd and its subsidiaries, conforming with the Companies Acts so far as the information given will permit.

‘Ignore taxation.

Step by Step Answer:

Business Accounting Uk Gaap Volume 2

ISBN: 9780273718802

1st Edition

Authors: Alan Sangster, Frank Wood