From the following trial balance for E Soormally, produce a statement of comprehensive income for the period

Question:

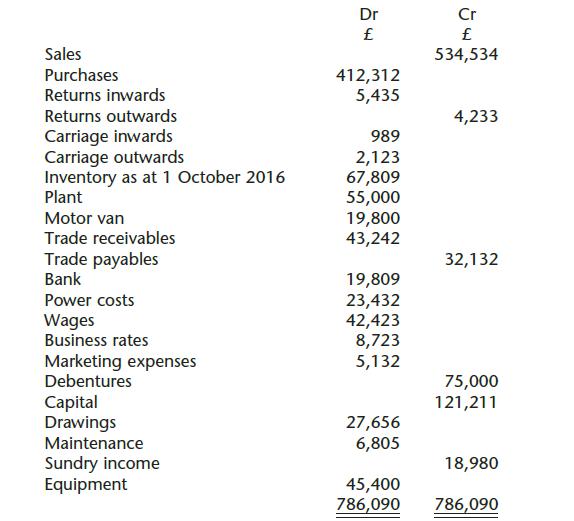

From the following trial balance for E Soormally, produce a statement of comprehensive income for the period ending 30 September 2017 and a statement of financial position as at that date.

Inventory at 30 September 2017 was valued at £53,673.

Transcribed Image Text:

Sales Purchases Returns inwards Returns outwards Carriage inwards Carriage outwards Inventory as at 1 October 2016 Plant Motor van Trade receivables Trade payables Bank Power costs Wages Business rates Marketing expenses Debentures Capital Drawings Maintenance Sundry income Equipment Dr 412,312 5,435 989 2,123 67,809 55,000 19,800 43,242 19,809 23,432 42,423 8,723 5,132 27,656 6,805 45,400 786,090 Cr 534,534 4,233 32,132 75,000 121,211 18,980 786,090

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 0% (2 reviews)

E Soormally Statement of comprehensive income for period ending 30 September 2017 Sales Les...View the full answer

Answered By

Usman Nasir

I did Master of Commerce in year 2009 and completed ACCA (Association of Chartered Certified Accountants) in year 2013. I have 10 years of practical experience inclusive of teaching and industry. Currently i am working in a multinational company as finance manager and serving as part time teacher in a university. I have been doing tutoring via many sites. I am very strong at solving numerical / theoretical scenario-based questions.

4.60+

16+ Reviews

28+ Question Solved

Related Book For

Frank Woods Business Accounting Basics

ISBN: 9780273725008

1st Edition

Authors: Frank Wood, Mr David Horner

Question Posted:

Students also viewed these Business questions

-

Question 1 This question has two parts, (A) and (B). Answer both parts. 100% Liverpool plc is a company that manufactures a number of different types of electrical goods and has a year end of 31...

-

The following trial balance relates to Amethyst as at 31 March 2015: The following information is relevant: 1. After the year end stock take it was discovered that goods worth $4 million, which were...

-

Tareq is a junior sales representative for a large equipment manufacturer. Sarah, a senior sales representative, has requested that Tareq help her prepare a sales presentation for a new prospect. As...

-

How would you apply this concepts to call center statistics? There are two numerical ways of describing quantitative variables, namely measures of location, and measures of dispersion. Measures of...

-

Update Table 12.2 for the most recent year for which data are available. Asia and Of which Total Canada Europe Latin America Year Pacific Japan Others 1980 1985 1990 1995 2000 2005 2010 2014 215.6...

-

Figure 10.19 suggests using a horizontal bar chart to rank and compare items. Some writers also use column charts for that purpose. What are the pros and cons of using horizontal bars versus vertical...

-

7. Explain the circumstances under which fair-value hedge accounting should be used and when cash-flow hedge accounting should be used.

-

Suppose a customer rents a vehicle for three months from Commodores Rental on November 1, paying $6,000 ($2,000/month). (1) Record the rental for Commodores on November 1. (2) Record the adjusting...

-

Rachel's Pet Supply Corporation manufactures two models of grooming stations, a standard and a deluxe model. The following activity and cost information has been compiled: Activity Overhead cost Cost...

-

From the following data construct a statement of comprehensive income for S Rogers for the year ending 31 July 2018 and a statement of financial position as at that date. Inventory at 31 July 2018...

-

From the following trial balance construct the statement of comprehensive income for D Wilcox for the year ended 31 July 2015 and a statement of financial position as at that date. Inventory at 31...

-

MULTIPLE-CHOICE QUESTIONS 1. The auditor is testing the operating effectiveness of controls in the revenue cycle and notes the following: (a) the organization does not regularly follow its credit...

-

The Tokyo Olympics. After watching how the tokyo olympics became the most expensive summer game ever video answer the following questions. Q 3 : As you saw in the video, the capital investment a city...

-

write at least two paragraphs discussing the experiences of individuals who identify outside the traditional binary gender system (male/female.) Please explore the challenges they face and how...

-

Newly formed S&J Iron Corporation has 163,000 shares of $5 par common stock authorized. On March 1, Year 1, S&J Iron issued 9,000 shares of the stock for $12 per share. On May 2, the company issued...

-

Use the SMOKE for this question. The variable cigs is the number of cigarettes smoked per day. How many people in the sample do not smoke at all? What fraction of people claim to smoke 20 cigarettes...

-

Transcribed image text : Reproduced below from Farthington Supply's accounting records is the accounts receivable subledger along with selected general ledger accounts. Dec. 31/19 Balance Credit...

-

What information is required to determine a deceased taxpayers tax payable?

-

SCHEDULE OF COST OF GOODS MANUFACTURED The following information is supplied for Sanchez Welding and Manufacturing Company. Prepare a schedule of cost of goods manufactured for the year ended...

-

Vogel, Inc., an S corporation for five years, distributes a tract of land held as an investment to Jamari, its majority shareholder. The land was purchased for $45,000 ten years ago and is currently...

-

Jonas is a 60% owner of Ard, an S corporation. At the beginning of the year, his stock basis is zero. Jonass basis in a $20,000 loan made to Ard and evidenced by Ards note has been reduced to $0 by...

-

Kaiwan, Inc., a calendar year S corporation, is partly owned by Sharrod, whose beginning stock basis is $32,000. During the year, Sharrods share of a Kaiwan long-term capital gain (LTCG) is $5,000,...

-

Calculate Social Security taxes, Medicare taxes and FIT for Jordon Barrett. He earns a monthly salary of $11,100. He is single and claims 1 deduction. Before this payroll, Barretts cumulative...

-

Bass Accounting Services expects its accountants to work a total of 26,000 direct labor hours per year. The company's estimated total indirect costs are $ 260,000. The company uses direct labor hours...

-

The Balance Sheet has accounts where the accountant must make estimates. Some situations in which estimates affect amounts reported in the balance sheet include: Allowance for doubtful accounts....

Study smarter with the SolutionInn App