P plc acquired 80 per cent of the ordinary share capital of S plc for 150,000 and

Question:

P plc acquired 80 per cent of the ordinary share capital of S plc for £150,000 and 50 per cent of the issued 10 per cent cumulative preference shares for £10,000, both purchases being effected on 1 May 2007. There have been no changes in the issued share capital of S plc since that date. The following balances are taken from the books of the two companies at 30 April 2008:

The following additional information is available:

(a) Stocks of P plc include goods purchased from S plc for £20,000. S plc charged out these stocks at cost plus 25 per cent.

(b) Proposed dividend of £10,000 by S plc includes a full year’s preference dividend. No interim dividends were paid during the year by either company.

(c) Creditors of P plc include £6,000 payable to S plc in respect of stock purchases. Debtors of S plc include £10,000 due from P plc. The holding company sent a cheque for £4,000 to its subsidiary on 29 April 2008 which was not received by S plc until May 2008.

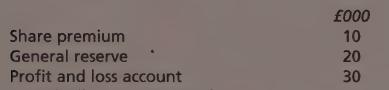

(d) At 1 May 2007 the balances on the reserves of S plc were as follows:

(e) Goodwill is not amortised.

Required:

(a) Prepare a consolidated balance sheet for P plc and its subsidiary S plc at 30 April 2008.

Notes to the accounts are not required. Workings must be shown.

(b) Explain what is meant by the term ‘cost of control’ and justify your treatment of this item in the above accounts.

Step by Step Answer:

Business Accounting Uk Gaap Volume 2

ISBN: 9780273718802

1st Edition

Authors: Alan Sangster, Frank Wood