Produce a trial balance from the data in question 2.21. Question 2.21: Post the following transactions to

Question:

Produce a trial balance from the data in question 2.21.

Question 2.21:

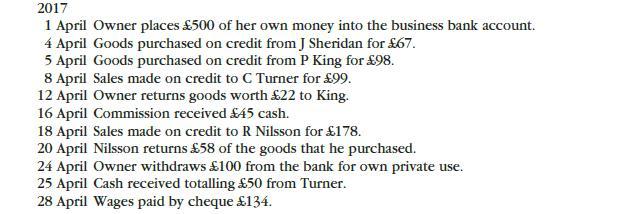

Post the following transactions to the double-entry accounts of D Weir and balance off the

accounts at 30 April 2017.

Transcribed Image Text:

2017 1 April Owner places 500 of her own money into the business bank account. 4 April Goods purchased on credit from J Sheridan for 67. 5 April Goods purchased on credit from P King for 98. 8 April Sales made on credit to C Turner for 99. 12 April Owner returns goods worth 22 to King. 16 April Commission received 45 cash. 18 April Sales made on credit to R Nilsson for 178. 20 April Nilsson returns 58 of the goods that he purchased. 24 April Owner withdraws 100 from the bank for own private use. 25 April Cash received totalling 50 from Turner. 28 April Wages paid by cheque 134.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (QA)

Capital Bank Purchases J Sheridan P King Sales Re...View the full answer

Answered By

Sarfraz gull

have strong entrepreneurial and analytical skills which ensure quality tutoring and mentoring in your international business and management disciplines. Over last 3 years, I have expertise in the areas of Financial Planning, Business Management, Accounting, Finance, Corporate Finance, International Business, Human Resource Management, Entrepreneurship, Marketing, E-commerce, Social Media Marketing, and Supply Chain Management.

Over the years, I have been working as a business tutor and mentor for more than 3 years. Apart from tutoring online I have rich experience of working in multinational. I have worked on business management to project management.

5.00+

3+ Reviews

10+ Question Solved

Related Book For

Frank Woods Business Accounting Basics

ISBN: 9780273725008

1st Edition

Authors: Frank Wood, Mr David Horner

Question Posted:

Students also viewed these Business questions

-

Using the information of Val Orara at the end of April 2022 (shown in figure 6.90) and the transactions for May: enter the appropriate journal abbreviation next to each transaction prepare the...

-

Produce a trial balance from the data in question 2.20. Question 2.20: Construct the double-entry accounts of Helen Clews from the following transactions and balance off each account at the end of...

-

Produce a trial balance from the data in question 2.22. Question 2.22: Construct the double-entry accounts for the following transactions of N James, a sole trader, and balance off each account at...

-

Jake, a single taxpayer, has $100,000 of ordinary income, a $10,000 net short-term capital loss, and $7,000 of qualified dividends. What is the result?

-

What criticisms have been levied against the United Nations study that Prebisch and Singer quoted in their work to confirm their belief?

-

The five-year swap rate when cash flows are exchanged semiannually is 4%. A company wants a swap where it receives payments at 4.2% per annum on a principal of $10 million. The OIS zero curve is flat...

-

P 13-5 Foreign currency hedge, existing receivable On January 1, 2017, Song delivers merchandise to Prabu for 250,000,000 Indonesian rupiah when the spot rate for the rupiah is 0.39 rupiah. The...

-

Five years ago a dam was constructed to impound irrigation water and to provide flood protection for the area below the dam. Last winter a 100-year flood caused extensive damage both to the dam and...

-

Production and Purchases Budgets Drainage Solutions Culverts produces small culverts for water drainage under two-lane dirt roads. Budgeted unit sales for the next several months are: Month Sales...

-

The following trial balance has been completed but errors have been made. You are to redraft the trial balance in correct form. You can assume that the balance on the suspense account will be zero in...

-

Construct the double-entry accounts for the following transactions of N James, a sole trader, and balance off each account at the end of the month. 2016 1 January Business is started with opening up...

-

When a parent company applies the initial value method or the partial equity method to an investment, worksheet adjustment must be made to the parents beginning Retained Earnings account (Entry *C)...

-

Exercise 11-5 Profit allocation in a partnership LO3 Dallas and Weiss formed a partnership to manage rental properties, by investing $198,000 and $242,000, respectively. During its first year, the...

-

Reading following articles and answer the questions: https://www.afr.com/technology/ai-is-coming-for-white-collar-jobs-gates-warns-20230123-p5cev7...

-

1. Citing an example in each case, briefly explain four types of book keeping errors which are not disclosed by trial balance 2. The trial balance extracted from the books of james as at 30 september...

-

Use the universal gravitation formula to determine which object has a larger effect on the Earth's motion through space: the Sun or the Moon. Explain how you are determining this, including very...

-

Pro Cycling Shop is a medium-size seller of the high-end bicycle. Since starting the company 15 years ago, Pro Cycling Shop has been a competitive company across Sarawak, Brunei, Kalimantan, and...

-

Describe the features of the Home Buyers Plan (HBP) and the Lifelong Learning Plan (LLP).

-

On January 1, 2017, McIlroy, Inc., acquired a 60 percent interest in the common stock of Stinson, Inc., for $340,200. Stinson's book value on that date consisted of common stock of $100,000 and...

-

Distinguish between strategy decisions and operational decisions, illustrating for a local retailer.

-

In your own words, explain what customer equity means and why it is important.

-

Distinguish between a strategy, a marketing plan, and a marketing program, illustra t ing for a local retailer.

-

why should Undertake research to review reasons for previous profit or loss?

-

A pension fund's liabilities has a PV01 of $200 million. The plan has $100 billion of assets with a weighted average modified duration of 8. The highest duration bond that the plan can invest in has...

-

Metlock Limited has signed a lease agreement with Lantus Corp. to lease equipment with an expected lifespan of eight years, no estimated salvage value, and a cost to Lantus, the lessor of $170,000....

Study smarter with the SolutionInn App