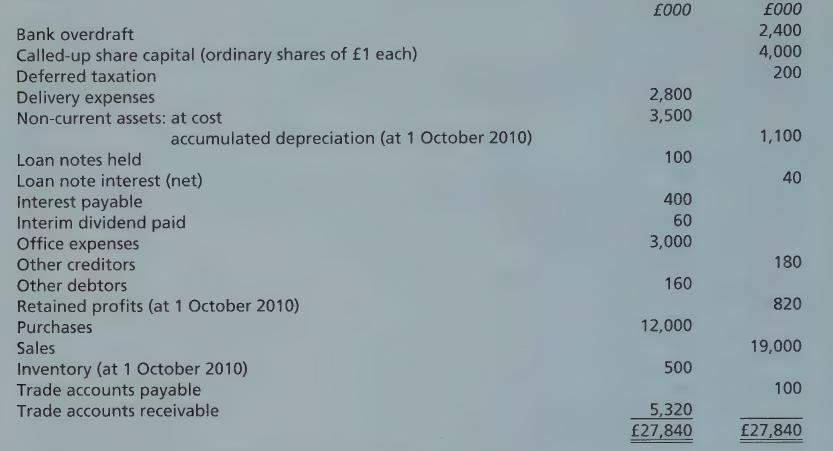

The following information has been extracted from the books of Quire plc as at 30 September 2011.

Question:

The following information has been extracted from the books of Quire plc as at 30 September 2011.

The following additional information is to be taken into account:

1 Inventory at 30 September 2011 was valued at £400,000.

2 All items in the above trial balance are shown net of value added tax.

3 At 30 September 2011, £130,000 was outstanding for office expenses, and £50,000 had been paid in advance for delivery van licences.

4 Depreciation at a rate of 50% is to be charged on the historic cost of the tangible non-current assets using the reducing balance method: it is to be apportioned as follows:

There were no purchases or sales of non-current assets during the year to 30 September 2011.

5 The following rates of taxation are to be assumed:

The corporation tax payable based on the profits for the year to 30 September 2011 has been estimated at £80,000.

6 A transfer of £60,000 is to be made from the deferred taxation account.

7 The directors propose to pay a final ordinary dividend of 3p per share.

Required:

In so far as the information permits, prepare Quire plc's income statement for the year ending 30 September 2011, and a balance sheet as at that date in accordance with the requirements of the relevant accounting standards.

Step by Step Answer:

Frank Woods Business Accounting Volume 2

ISBN: 9780273712138

11th Edition

Authors: Frank Wood, Alan Sangster