The following trial balance has been extracted from the books of Patt plc as at 31 March

Question:

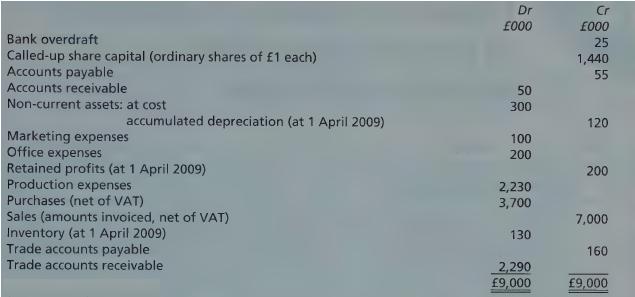

The following trial balance has been extracted from the books of Patt plc as at 31 March 2010:

Additional information:

1 Following the preparation of the above trial balance, the following additional matters need to be taken into account:

(a) inventory at 31 March 2010 was valued at £170,000;

(6) at 31 March 2010, £20,000 was owing for office expenses, and £15,000 had been paid in advance for marketing expenses;

(c) a customer had gone into liquidation owing the company £290,000; the company does not expect to recover any of this debt;

(d) the company decides to set up an allowance for doubtful debts amounting to 5% of the outstanding trade accounts receivable as at the end of each financial year; and

(e) depreciation is to be charged on the non-current assets at a rate of 20% on cost; it is to be apportioned as follows:

2 Corporation tax (based on the accounting profit for the year at a rate of 35%) is estimated to be £160,000. The basic rate of income tax is assumed to be 25%.

3 The directors are to recommend the payment of a dividend of 10p per ordinary share.

Required:

In so far as the information permits, prepare Patt plc’s income statement for the year ending 31 March 2010, and a balance sheet as at that date in accordance with the relevant accounting standards.

(i) Where appropriate, formal notes should be attached to your income statement and balance sheet. However, a statement of accounting policies is NOT required.

(ii) Detailed workings should also be submitted with your solution. They should be clearly designated as such, and they must not form part of your formal notes.

Step by Step Answer:

Frank Woods Business Accounting Volume 2

ISBN: 9780273712138

11th Edition

Authors: Frank Wood, Alan Sangster