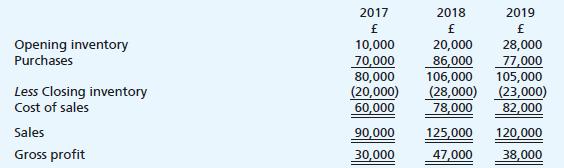

The following information is available for the years 2017, 2018 and 2019: The inventory valuations used above

Question:

The following information is available for the years 2017, 2018 and 2019:

The inventory valuations used above at the end of 2017 and at the end of 2018 were inaccurate. The inventory at 31 December 2017 had been under-valued by £1,000, whilst that at 31 December 2018 had been over-valued by £3,000.

Required:

(a) Give the corrected figures of gross profit for each of the years affected by the errors in inventory valuation.

(b) Using the figures in the revised trading accounts, calculate for each year:

(i) the percentage of gross profit to sales, and (ii) the rate of turnover of inventory.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Frank Woods Business Accounting An Introduction To Financial Accounting

ISBN: 9781292365435

15th Edition

Authors: Alan Sangster, Lewis Gordon, Frank Wood

Question Posted: