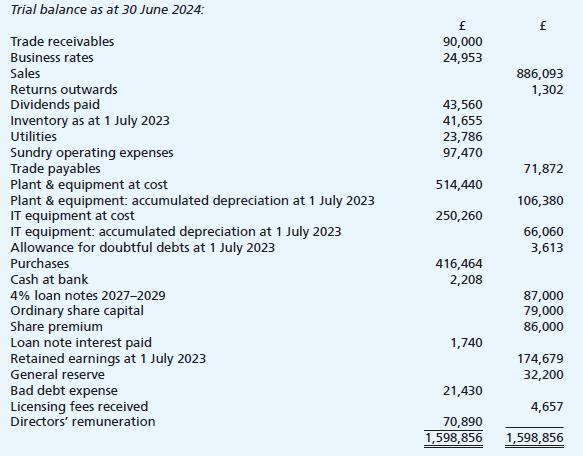

The following information regarding Mashra Ltd relates to its year ended 30 June 2024: Additional information: (i)

Question:

The following information regarding Mashra Ltd relates to its year ended 30 June 2024:

Additional information:

(i) The inventory was counted at 30 June 2024 and was valued at a cost of £44,767.

(ii) Depreciation is to be charged at the following annual rates:

![]()

(iii) The amount shown for business rates on the trial balance includes a payment of £9,240, which represents twelve months’ rates to 30 September 2024.

(iv) Utilities charges incurred before the year end for which no invoices have yet been received amount to a total of £6,203.

(v) After a detailed review of collections from credit customers, it has been determined that the allowance for doubtful debts is to be changed to 3% of trade receivables.

(vi) The loan note interest is paid in two annual instalments and the second instalment needs to be provided for.

(vii) The corporation tax charge on the profit for the year is estimated to be £28,000.

(viii) The directors wish to transfer £6,000 to general reserve.

Required:

Prepare an income statement for Mashra Ltd for the year ended 30 June 2024 as well as a balance sheet as at that date. Both statements should be in a form appropriate for publication.

Step by Step Answer:

Frank Woods Business Accounting An Introduction To Financial Accounting

ISBN: 9781292365435

15th Edition

Authors: Alan Sangster, Lewis Gordon, Frank Wood