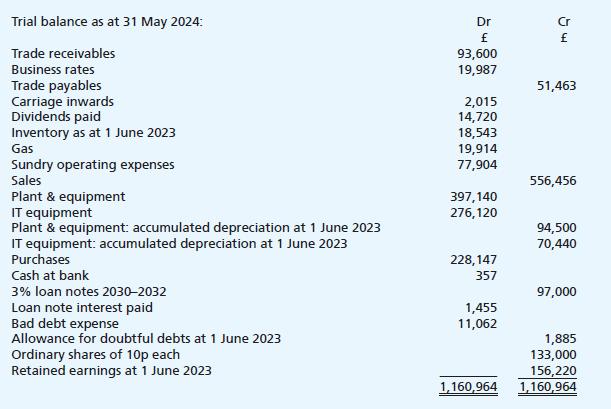

You are given the following information for Rinchi Ltd in relation to its financial year ended 31

Question:

You are given the following information for Rinchi Ltd in relation to its financial year ended 31 May 2024:

Further information:

(i) The company’s inventory was counted on 31 May 2024 and was valued at a cost of £19,994.

(ii) Depreciation is to be charged at the following rates per annum:

![]()

(iii) The amount shown for business rates on the trial balance includes a payment of £11,340 which represents twelve months’ rates to 30 September 2024.

(iv) Gas charges incurred before the end of the financial year for which no invoices have yet been received amount to a total of £3,956.

(v) Following a detailed analysis of the company’s experience with collections from credit customers, the allowance for doubtful debts is to be set at 3% of trade receivables.

(vi) The loan note interest is paid in two annual instalments and the second instalment needs to be provided for.

(vii) The corporation tax charge on the profit for the year is estimated to be £10,000.

Required Prepare an income statement for Rinchi Ltd for the year ended 31 May 2024 and a balance sheet as at that date:

(a) for internal use; and

(b) in a form suitable for publication (or ‘external use’).

Step by Step Answer:

Frank Woods Business Accounting An Introduction To Financial Accounting

ISBN: 9781292365435

15th Edition

Authors: Alan Sangster, Lewis Gordon, Frank Wood