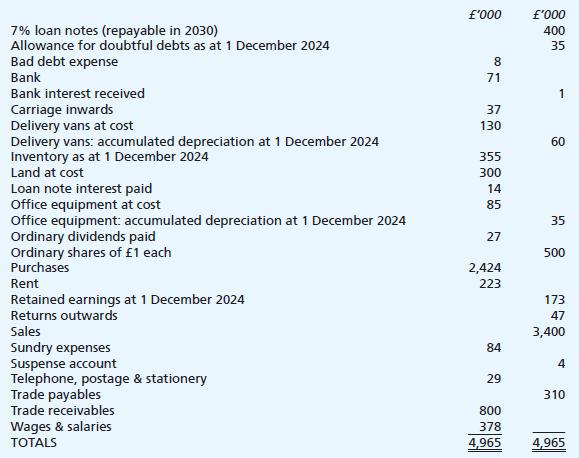

You are presented with the trial balance of Finnax Ltd at 30 November 2025 below: You are

Question:

You are presented with the trial balance of Finnax Ltd at 30 November 2025 below:

You are also provided with the following additional information:

(i) Inventory at 30 November 2025 was counted and valued at a cost of £399,000.

(ii) Towards the end of the year, the company’s land was valued by a firm of professional valuers at £0.75m. The directors of Finnax Ltd wish to recognise this valuation in the financial statements.

(iii) The suspense account represents £4,000 received from the sale of a delivery van on 1 December 2024. The van had originally cost £14,000 many years ago and had been fully depreciated. No adjustment has yet been made to the delivery vans or accumulated depreciation accounts in respect of this disposal.

(iv) Depreciation is to be provided for the year at 25% straight line on delivery vans and at 30%

reducing balance on office equipment.

(v) Telephone charges incurred by Finnax Ltd up to 30 November 2025, for which no bill has yet been received, were estimated to be £3,000.

(vi) Rent includes a payment of £54,000 made on 15 October 2025 paid in respect of the three months to 31 December 2025.

(vii) The company has recently learnt that a credit customer who owed £20,000 as at the end of the year has gone bankrupt and it is not now expected that any of this debt will be recovered.

Furthermore, based on the evidence of its history of debt collection, Finnax Ltd requires an allowance for doubtful debts equal to 5% of outstanding trade receivables.

(viii) Interest on the loan notes is paid in twice-yearly instalments and the outstanding payment for the year needs to be provided for.

(ix) Corporation tax due on the profit for the year is estimated to be £72,000.

Required:

In a publishable format, prepare an income statement for Finnax Ltd for the year ended 20 November 2025 as well as a balance sheet as at that date.

Step by Step Answer:

Frank Woods Business Accounting An Introduction To Financial Accounting

ISBN: 9781292365435

15th Edition

Authors: Alan Sangster, Lewis Gordon, Frank Wood