BAK Ltd. is considering purchasing one of two new diagnostic machines. Either machine would make it possible

Question:

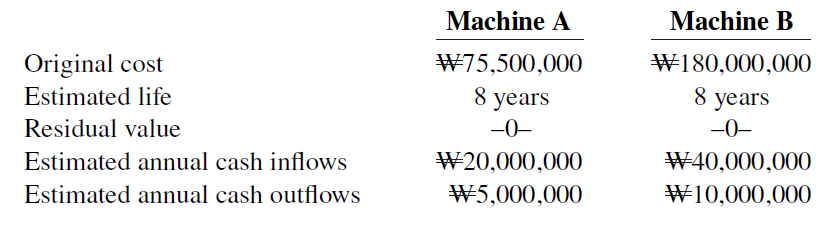

BAK Ltd. is considering purchasing one of two new diagnostic machines. Either machine would make it possible for the company to bid on jobs that it currently is not equipped to do. Estimates regarding each machine are provided below.

Instructions

Calculate the net present value and profitability index of each machine. Assume a 9% discount rate. Which machine should be purchased?

Net Present ValueWhat is NPV? The net present value is an important tool for capital budgeting decision to assess that an investment in a project is worthwhile or not? The net present value of a project is calculated before taking up the investment decision at...

Transcribed Image Text:

Machine A Machine B Original cost W75,500,000 W180,000,000 8 years Estimated life Residual value Estimated annual cash inflows Estimated annual cash outflows 8 years -0- -0- W40,000,000 W10,000,000 W20,000,000 W5,000,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 66% (15 reviews)

Machine A Cash Flows X 9 Discount Factor Present Value Present value of ...View the full answer

Answered By

Ashington Waweru

I am a lecturer, research writer and also a qualified financial analyst and accountant. I am qualified and articulate in many disciplines including English, Accounting, Finance, Quantitative spreadsheet analysis, Economics, and Statistics. I am an expert with sixteen years of experience in online industry-related work. I have a master's in business administration and a bachelor’s degree in education, accounting, and economics options.

I am a writer and proofreading expert with sixteen years of experience in online writing, proofreading, and text editing. I have vast knowledge and experience in writing techniques and styles such as APA, ASA, MLA, Chicago, Turabian, IEEE, and many others.

I am also an online blogger and research writer with sixteen years of writing and proofreading articles and reports. I have written many scripts and articles for blogs, and I also specialize in search engine

I have sixteen years of experience in Excel data entry, Excel data analysis, R-studio quantitative analysis, SPSS quantitative analysis, research writing, and proofreading articles and reports. I will deliver the highest quality online and offline Excel, R, SPSS, and other spreadsheet solutions within your operational deadlines. I have also compiled many original Excel quantitative and text spreadsheets which solve client’s problems in my research writing career.

I have extensive enterprise resource planning accounting, financial modeling, financial reporting, and company analysis: customer relationship management, enterprise resource planning, financial accounting projects, and corporate finance.

I am articulate in psychology, engineering, nursing, counseling, project management, accounting, finance, quantitative spreadsheet analysis, statistical and economic analysis, among many other industry fields and academic disciplines. I work to solve problems and provide accurate and credible solutions and research reports in all industries in the global economy.

I have taught and conducted masters and Ph.D. thesis research for specialists in Quantitative finance, Financial Accounting, Actuarial science, Macroeconomics, Microeconomics, Risk Management, Managerial Economics, Engineering Economics, Financial economics, Taxation and many other disciplines including water engineering, psychology, e-commerce, mechanical engineering, leadership and many others.

I have developed many courses on online websites like Teachable and Thinkific. I also developed an accounting reporting automation software project for Utafiti sacco located at ILRI Uthiru Kenya when I was working there in year 2001.

I am a mature, self-motivated worker who delivers high-quality, on-time reports which solve client’s problems accurately.

I have written many academic and professional industry research papers and tutored many clients from college to university undergraduate, master's and Ph.D. students, and corporate professionals. I anticipate your hiring me.

I know I will deliver the highest quality work you will find anywhere to award me your project work. Please note that I am looking for a long-term work relationship with you. I look forward to you delivering the best service to you.

3.00+

2+ Reviews

10+ Question Solved

Related Book For

Accounting Principles

ISBN: 978-1119419617

IFRS global edition

Authors: Paul D Kimmel, Donald E Kieso Jerry J Weygandt

Question Posted:

Students also viewed these Business questions

-

Kohima Ltd. is involved in the business of injection molding of plastics. It is considering the purchase of a new computer-aided design and manufacturing machine for Rs4,300,000. The company believes...

-

Luang Textiles is considering the purchase of a new machine. Its invoice price is 122,000, freight charges are estimated to be 3,000, and installation costs are expected to be 5,000. Residual value...

-

Peyton Smith enjoys listening to all types of music and owns countless CDs. Over the years, Peyton has gained a local reputation for knowledge of music from classical to rap and the ability to put...

-

Is a flat-rate or flat-fee system more efficient for pricing scarce water? Why?

-

A cold beer with an initial temperature of 35F warms up to 40F in 10 minutes while sitting in a room with temperature 70F. What will the temperature of the beer be after t minutes? After 20 minutes?

-

Do you use water for things that are beyond what is necessary to sustain life? What if the price of water in your home tripled? How would you respond? Are there activities that you would change or...

-

Treating cancer with yoga. According to a study funded by the National Institutes of Health, yoga classes can help cancer survivors sleep better. The study results were presented at the June 2010...

-

If an asset that is not fully depreciated is sold or disposed, but the fixed asset records are not adjusted, what effect will this have on the financial statements?

-

Rosewood College ( c ) FA II: Assignment 1 - COGS & Bank Reconciliation The following data pertains to Home Office Company for the year ended December 3 1 , 2 0 2 0 : Sales ( 2 5 % were cash sales )...

-

In the reverse-bias region the saturation current of a silicon diode is about 0.1 A (T = 20C). Determine its approximate value if the temperature is increased 40C.

-

Alpine Clothing manufactures snowsuits. Alpine is considering purchasing a new sewing machine at a cost of 2.45 million. Its existing machine was purchased five years ago at a price of 1.8 million;...

-

BSU Ltd. wants to purchase a new machine for 29,300, excluding 1,500 of installation costs. The old machine was purchased five years ago and had an expected economic life of 10 years with no residual...

-

A small theater has a seating capacity of 2000. When the ticket price is $20, attendance is 1500. For each $1 decrease in price, attendance increases by 100. (a) Write the revenue R of the theater as...

-

1) Why do you believe that in recent years PE sponsors have increasingly chosen to buy debt in their distressed LBOs? 2) What are the pros and cons of this investment strategy? 3) What issues are...

-

Paper Street Soap Company Ltd conducts a business that makes luxury soaps. It operates a factory in Oyster Bay near Sydney. The factory contains a large amount of equipment that is used in the...

-

TRANSACTION ANALYSIS: Dartmouth Ties Corporation is a merchandising company that has been in operation for two years. The company sell high - end ties for men. They purchase their inventory from...

-

Using your knowledge of types of group influence and of subcultures, explain the potential impact on consumer behavior of Methodism's tightening of its ban on gay marriage and LGBTA clergy. Write in...

-

A language L over an alphabet is co-finite, if * \ Lis empty or finite. Let COFNFA = {(N) | N is a NFA accepting a co-finite language}. Show that COF NFA is decidable.

-

Javon Co. set standards of 3 hours of direct labor per unit at a rate of $15 per hour. During October, the company actually uses 16,250 hours of direct labor at a $247,000 total cost to produce 5,600...

-

Which of the following streaming TV devices does not involve use of a remote controller? A) Google Chromecast B) Apple TV C) Amazon Fire TV D) Roku

-

Thogmartin Company uses special journals. It recorded in a sales journal a sale made on account to R. Peters for $435.A few days later, R. Peters returns $70 worth of merchandise for credit. Where...

-

A $500 purchase of merchandise on account from Lore Company was properly recorded in the purchases journal. When posted, however, the amount recorded in the subsidiary ledger was $50. How might this...

-

A $500 purchase of merchandise on account from Lore Company was properly recorded in the purchases journal. When posted, however, the amount recorded in the subsidiary ledger was $50. How might this...

-

Your firm is planning to invest in an automated packaging plant. Harburtin Industries is an all - equity firm that specializes in this business. Suppose Harburtin ' s equity beta is 0 . 8 7 , the...

-

Ned Allen opened a medical practice in Los Angeles, California, and had the following transactions during the month of January. (Click the icon to view the January transactions.) Journalize the...

-

do you need more information or are you working on this? Irene Watts and John Lyon are forming a partnership to which Watts will devote one- half time and Lyon will devote full time. They have...

Study smarter with the SolutionInn App