Diegos Custom Construction is considering three new projects, each requiring an equipment investment of 22,000. Each project

Question:

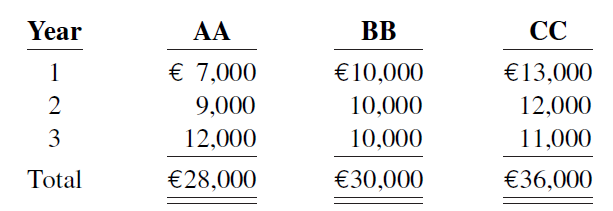

Diego’s Custom Construction is considering three new projects, each requiring an equipment investment of €22,000. Each project will last for 3 years and produce the following net annual cash flows.

The equipment’s residual value is zero, and Diego uses straight-line depreciation. Diego will not accept any project with a cash payback period over 2 years. Diego’s required rate of return is 12%.

Instructions

a. Compute each project’s payback period, indicating the most desirable project and the least desirable project using this method. (Round to two decimals and assume in your computations that cash flows occur evenly throughout the year.)

b. Compute the net present value of each project. Does your evaluation change? (Round to nearest euro.)

Net Present ValueWhat is NPV? The net present value is an important tool for capital budgeting decision to assess that an investment in a project is worthwhile or not? The net present value of a project is calculated before taking up the investment decision at... Payback Period

Payback period method is a traditional method/ approach of capital budgeting. It is the simple and widely used quantitative method of Investment evaluation. Payback period is typically used to evaluate projects or investments before undergoing them,...

Step by Step Answer:

Accounting Principles

ISBN: 978-1119419617

IFRS global edition

Authors: Paul D Kimmel, Donald E Kieso Jerry J Weygandt