Refer to Exhibit 17.14 and calculate Airspace?s liquidity and efficiency ratios for 2020 and 2019 (round answers

Question:

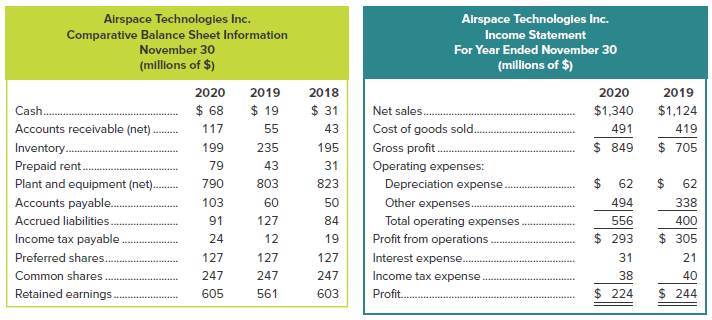

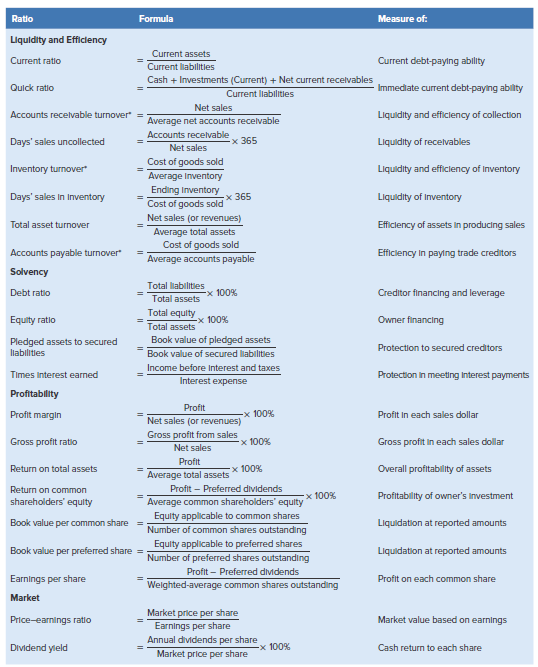

Refer to Exhibit 17.14 and calculate Airspace?s liquidity and efficiency ratios for 2020 and 2019 (round answers to two decimal places).

Analysis Component: Identify whether the change in each ratio from 2019 to 2020 was favourable (F) or unfavourable (U) and why.

Exhibit 17.14

Airspace Technologies Inc. Comparative Balance Sheet Information November 30 Airspace Technologies Inc. Income Statement For Year Ended November 30 (millions of $) (millions of $) 2019 2018 2020 2020 2019 Net sales. Cost of goods sold. Cash. Accounts receivable (net) . $ 68 $ 19 $ 31 $1,340 $1,124 117 55 43 491 419 $ 849 $ 705 199 195 Inventory.. 235 Gross profit. Prepaid rent. 79 43 31 Operating expenses: Depreciation expense Plant and equipment (net). 803 24 790 823 62 62 Accounts payable. 103 60 50 Other expenses. 494 338 127 556 Accrued liabilities. 91 84 Total operating expenses 400 $ 293 $ 305 Income tax payable Profit from operations. 24 12 19 Preferred shares. 127 127 127 Interest expense. 31 21 Common shares 247 247 247 Income tax expense 38 40 Retained earnings. $ 244 $ 224 605 561 603 Profit. %24 Ratio Formula Measure of: Liquldity and Efficlency Current assets Current ratio Current labilitles Current debt-paylng ability Cash + Investments (Current) + Net current recelvables Quick ratio Immedlate current debt-paying ability Current labilities Net sales Accounts recelvable turnover Liquidity and efficlency of collection Average net accounts recelvable Accounts recelvable Days' sales uncollected x 365 Liquidity of recelvables Net sales Cost of goods sold Inventory turnover Liquidity and efficlency of Inventory Average Inventory Ending Inventory Days' sales in Inventory x 365 Cost of goods sold Liquidity of Inventory Net sales (or revenues) Total asset turnover Efficlency of assets in producing sales Average total assets Cost of goods sold Accounts payable turnover Efficiency in paylng trade creditors Average accounts payable Solvency Total liabilities Debt ratio x 100% Creditor financing and leverage Total assets Total equity Equity ratio -x 100% Owner financing Total assets Book value of pledged assets Pledged assets to secured liabilitles Protection to secured creditors Book value of secured liabilities Income before Interest and taxes Times Interest earned Protection in meeting Interest payments Interest expense Profitability Profit Profit margin -x 100% Profit in each sales dollar Net sales (or revenues) Gross profit from sales Net sales Gross profit ratio x 100% Gross profit in each sales dollar Profit Return on total assets x 100% Overall profitability of assets Average total assets Profit – Preferred dividends Return on common shareholders' equity x 100% Profitability of owner's Investment Average common shareholders' equlty Equity applicable to common shares Book value per common share Liquidation at reported amounts Number of common shares outstanding Equity applicable to preferred shares Book value per preferred share = Liquidation at reported amounts Number of preferred shares outstanding Profit - Preferred dividends Earnings per share Profit on each common share Weighted-average common shares outstanding Market Market price per share Earnings per share Price-earnings ratio Market value based on earnings Annual dividends per share Market price per share Dividend yleld -x 100% Cash return to each share

Step by Step Answer:

Ratio Calculations Favorable or Unfavorable and Why 2020 2019 Current ratio 2121 1 1771 2 F because ...View the full answer

Fundamental Accounting Principles Volume II

ISBN: 978-1260305838

16th Canadian edition

Authors: Kermit Larson, Tilly Jensen, Heidi Dieckmann

Related Video

The Dupont analysis is an expanded return on equity formula, calculated by multiplying the net profit margin by the asset turnover by the equity multiplier. The DuPont analysis is also known as the DuPont identity or DuPont model.This Video will guide on how to calculate return on Equity and estimate profitability of shareholders using DuPont Analysis.

Students also viewed these Business questions

-

The standard direct labor cost per reservation for Harrys Hotel is $3 (= $12 per labor hour ÷ 4 reservations per hour). Actual direct labor costs during the period totaled $45,240....

-

Refer to Exhibit 17.14 and calculate Focus Metals? solvency ratios for 2019 and 2020 (round answers to two decimal places). Analysis Component: Identify whether the change in each ratio from 2019 to...

-

Refer to Exhibit 17.14 and calculate Tia?s Trampolines Inc.?s profitability ratios for 2020 (round calculations to two decimal places). Also identify whether each of Tia?s Trampolines Inc.?s...

-

A baseball player usually has four at bats each game. Suppose the baseball player is a lifetime 0.25 hitter. Find the probability that this player will have: (a) Two hits out of four at bats (b) No...

-

For which nonnegative integers n is 2n + 3 2n? Prove your answer.

-

If you were asked at your workplace to fill out a satisfaction survey, such as the Job Descriptive Index, would you participate? Why or why not? LO3

-

Linton Industries borrowed $500,000 from Security Bankers to finance the purchase of equip ment costing $360,000 and to provide $140,000 in cash. The note states that the loan matures in twenty...

-

The stockholders equity accounts of Lore Corporation on January 1, 2014, were as follows. Preferred Stock (10%, $100 par, noncumulative, 5,000 shares authorized) ...$ 300,000 Common Stock ($5 stated...

-

Music manufactures harmonicas. Woodsy uses standard costs to judge performance. Recently, a clerk mistakenly threw away some of the records, and only partial data for September exist. Woodsy knows...

-

Please solve this problem using C language Hacker Industries has a number of employees. The company assigns each employee a numeric evaluation score and stores these scores in a list. A manager is...

-

Eco Play Ltd., with its head office in Vancouver, manufactures enviro-friendly, safe playground equipment for elementary schools. Its 2020 balance sheet and income statement follow. Assume that the...

-

Web Structure Inc. calculated the ratios shown below for 2020 and 2019: Required 1. Identify whether the change in the ratios from 2019 to 2020 is favourable (F) or unfavourable (U). 2. Assess...

-

In the introduction to this chapter you learned about the development of the Google Photos service. Briefly describe two things the development team did that influenced the design of the service.

-

Claim: Fewer than 8.2% of homes have only a landline telephone and no wireless phone. Sample data: A survey by the National Center for Health Statistics showed that among 13,215 homes 5.78% had...

-

Among 450 randomly selected drivers in the 16 - 18 age bracket, 374 were in a car crash in the last year. If a driver in that age bracket is randomly selected, what is the approximate probability...

-

Construct a 90% confidence interval for the population standard deviation o at Bank A. Bank A 6.4 6.6 6.7 6.8 7.1 7.2 7.6 7.8 7.8 7.8

-

In 2002, after the accounting deceptions of the management of many multi-million dollar corporations (with Enron being the benchmark name of that time period), the Security and Exchange Commission...

-

1.Deduce the structure of a compound with molecular formula CsH100 that exhibits the following IR, H NMR, and 13C NMR spectra. Data from the mass spectrum are also provided. Mass Spec. Data relative...

-

Describe the fiduciary duty of loyalty.

-

Diamond Walker sells homemade knit scarves for $25 each at local craft shows. Her contribution margin ratio is 60%. Currently, the craft show entrance fees cost Diamond $1,500 per year. The craft...

-

Contrast these types of bonds: (a) Secured and unsecured. (b) Convertible and callable.

-

Contrast these types of bonds: (a) Secured and unsecured. (b) Convertible and callable.

-

Which accounts are debited and which are credited if a bond issue originally sold at a premium is redeemed before maturity at 97 immediately following the payment of interest? Discuss.

-

3 fiancial factors of singpore post limited during 2015 to 2020

-

Hello! Please help me answer this financial question: 1) A portfolio manager adds a new stock that has the same standard deviation of return as the existing portfolio but has a correlation...

-

8. Summarize the Tuckman readings on interest drift and volatility.

Study smarter with the SolutionInn App