Refer to Samsungs financial statements in Appendix A. What percent of its current assets is inventory as

Question:

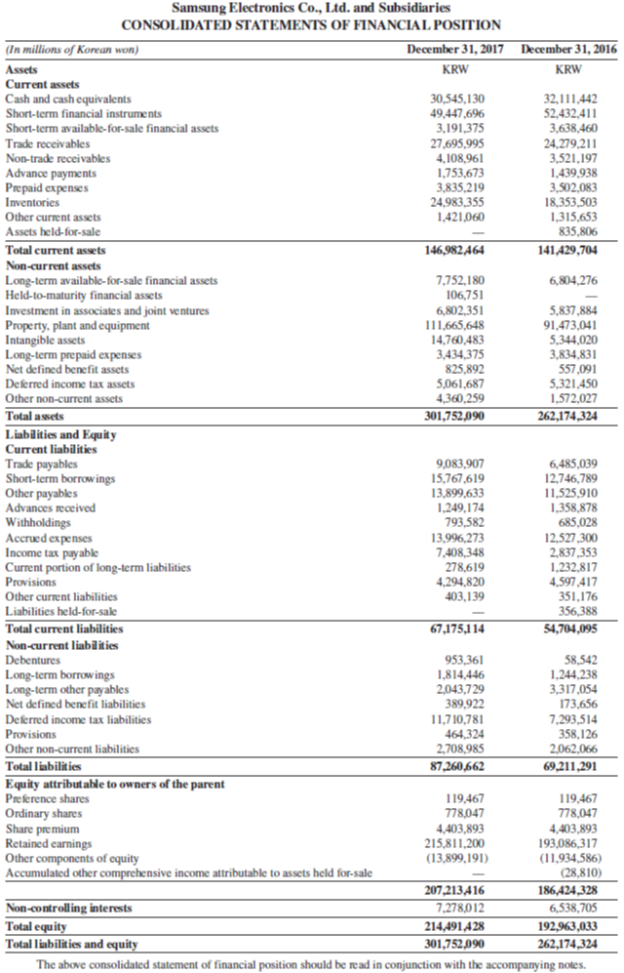

Refer to Samsung’s financial statements in Appendix A. What percent of its current assets is inventory as of December 31, 2017 and 2016?

Data from Appendix A

Financial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial...

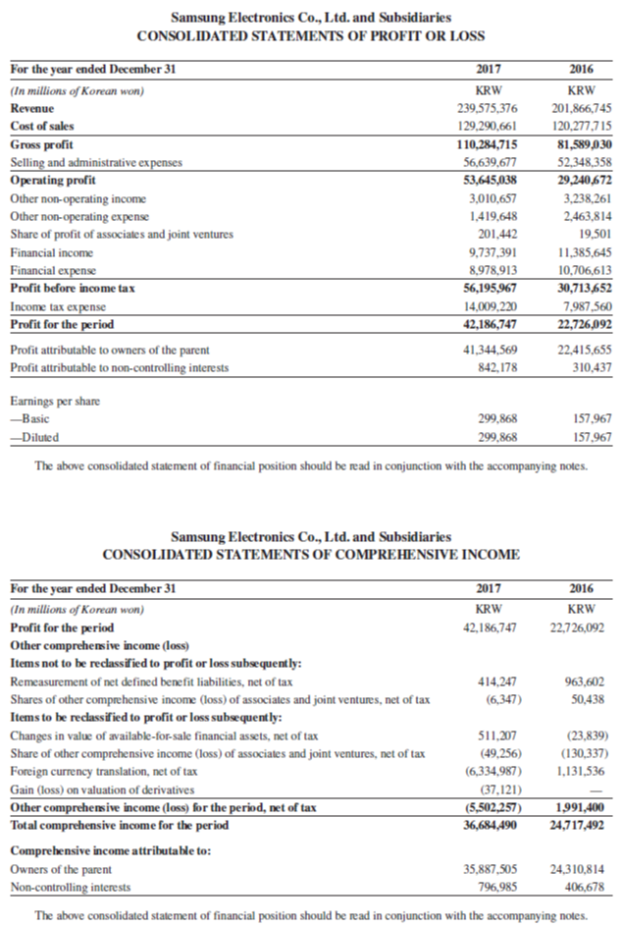

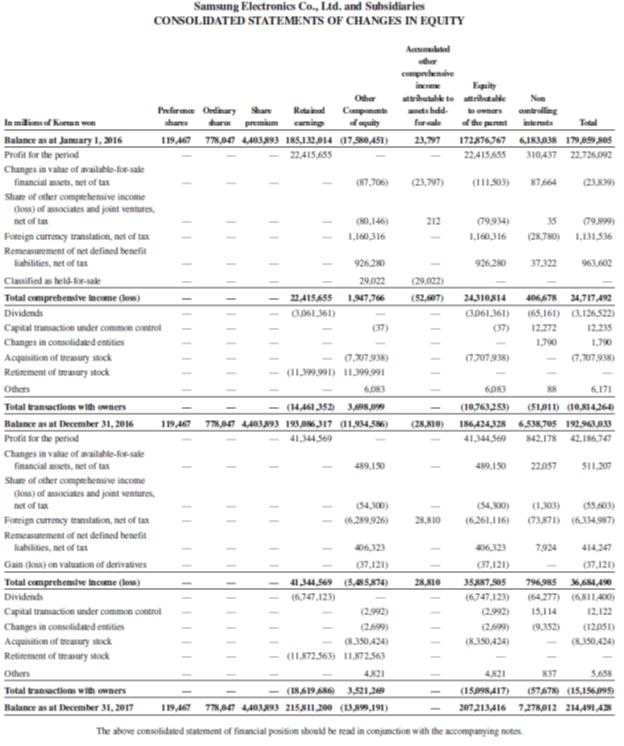

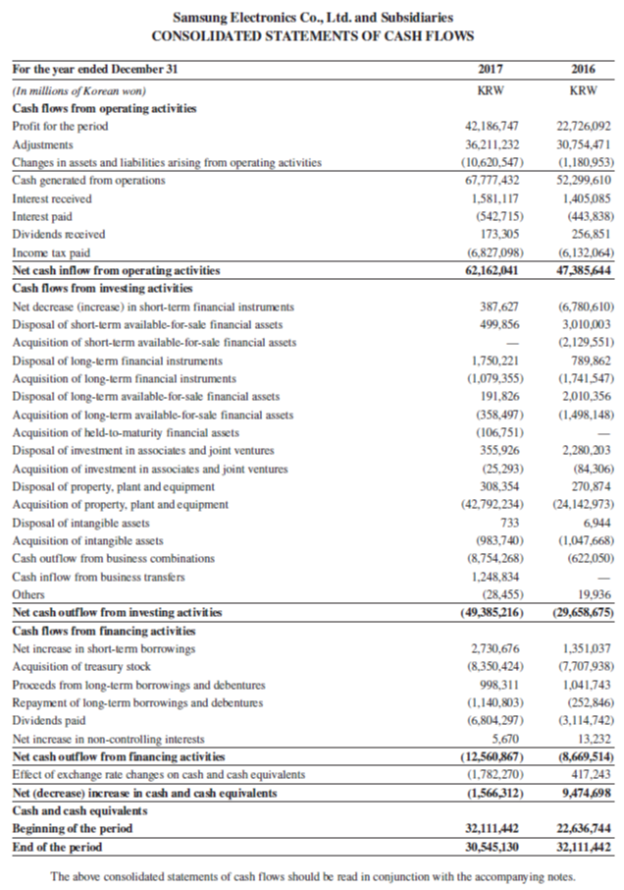

Samsung Electronics Co., Ltd. and Subsidiaries CONSOLIDATED STATEMENTS OF FINANCIAL POSITION December 31, 2017 December 31, 2016 (In millions of Korean won) Assets KRW KRW Current assets 30,545,130 49,447,696 3,191,375 27,695,995 4,108,961 1,753,673 3,835,219 24.983.355 1,421,060 Cash and cash equivalents Short-term financial instruments Short-term available-for-sale financial assets Trade receivables Non-trade receivables Advance payments Prepaid expenses Inventories 32,111,442 52,432,411 3,638,460 24,279,211 3,521,197 1,439,938 3,502,083 18,353,503 1,315,653 835,806 Other current assets Assets held-for-sale Total current assets 146,982,464 141,429,704 Non-current assets 7,752,180 106,751 6,802.351 111,665,648 14,760,483 3,434.375 Long-term available-for-sale financial assets Held-to-maturity financial assets Investment in associates and joint ventures Property, plant and equipment Intangible assets Long-term prepaid expenses Net defined benefit assets 6,804,276 5,837,884 91,473,041 5,344,020 3,834,831 557,091 5,321,450 1,572,027 825,892 5,061,687 4,360,259 301,752,090 Deferred income tax assets Other non-current assets Total assets 262,174,324 Liabilities and Equity Current liabilities Trade payables Short-term borrow ings Other payables Advances received 9,083,907 15,767,619 13,899,633 1,249,174 793,582 6,485,039 12,746,789 11,525,910 1,358,878 685,028 12,527,300 2,837,353 1,232,817 4,597,417 351,176 356,388 54,704,095 Withholdings Accrued expenses Income tax payable Current portion of long-term liabilities Provisions 13,996,273 7,408,348 278,619 4,294,820 403,139 Other current liabilities Liabilities held-for-sake Total current liabilities 67,175,1 14 Non-current liablities Debentures 58,542 1,244,238 3,317,054 173,656 7,293,514 358,126 2,062,066 69,211,291 953,361 1,814,446 2,043,729 389,922 Long-term borrowings Long-term other payables Net defined benefit liabilities 11,710,781 464324 2,708,985 87,260,662 Deferred income tax liabilities Provisions Other non-current liabilities Total liabilities Equity attribut able to owners of the parent Prekrence shares Ordinary shares Share premium Retained earnings Other components of equity Accumulated other comprehensive income attributable to assets held for-sale 119,467 778,047 4,403,893 215,811,200 (13,899,191) 119,467 778,047 4,403,893 193,086,317 (11,934,586) (28,810) 207,213416 186,424,328 Non-controlling interests Total equity Total linbilities and equity 7,278,012 214,491,428 6,538,705 192.963,033 301.752,090 262,174,324 The above consolidated statement of financial position should be read in conjunction with the accompanying notes. ||||| Samsung Electronics Co., Ltd. and Subsidiaries CONSOLIDATED STATEMENTS OF PROFIT OR LOSS For the year ended December 31 (In millions of Korean won) 2017 2016 KRW KRW Revenue 239,575,376 201,866,745 Cost of sales 129,290,661 120,277,715 81,589 030 52,348,358 29,240672 Gross profit Selling and administrative ex penses Operating profit Other non-operating income Other non-operating expense Share of profit of associates and joint ventures 110,284,715 56,639,677 53,645,038 3,010,657 3,238,261 1,419,648 2,463,814 201,442 19,501 Financial income 9,737,391 11,385,645 Financial expense Profit before income tax Income tax expense Profit for the period 8,978,913 56,195,967 10,706,613 30,713652 14,009,220 42,186,747 7,987,560 22,726,092 Profit attributable to owners of the parent 41,344,569 22,415,655 Profit attributable to non-controlling interests 842,178 310,437 Earnings per share --Basic 299,868 157,967 -Diluted 299,868 157,967 The above consolidated statement of financial position should be read in conjunction with the accompanying notes. Samsung Electronies Co., Ltd. and Subsidiaries CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME For the year ended December 31 (In millions of Korean won) 2017 KRW 2016 KRW Profit for the period 42,186,747 22,726,092 Other comprehensive income (loss) Items not to be reclassified to profit or loss subsequently: Remeasurement of net defined benefit liabilities, net of tax 414,247 963,602 Shares of other comprehensive income (loss) of associates and joint ventures, net of tax Items to be reclassified to profit or loss subsequently: (6,347) 50,438 511,207 (23,839) Changes in value of available-for-sale financial assets, net of tax Share of other comprehensive income (loss) of associates and joint ventures, net of tax Foreign currency translation, net of tax Gain (loss) on valuation of derivatives Other comprehensive income (loss) for the period, net of tax Total comprehensive income for the period (49,256) (6,334,987) (130,337) 1,131,536 (37,121) (5,502,257) 36,684,490 1,991,400 24,717,492 Comprehensive income attributable to: Owners of the parent 35,887,505 24,310,814 Non-controlling interests 796,985 406,678 The above consolidated statement of financial position should be read in conjunction with the accompanying notes.

Step by Step Answer:

Inventory comprises 170 computed as 24983355 14...View the full answer

Related Video

Financial statements of a business having numerous divisions or subsidiaries are called consolidated financial statements. Companies frequently refer to the aggregated reporting of their entire firm together when using the term \"consolidated\" in financial statement reporting. Consolidated financial statement reporting, on the other hand, is defined by the Financial Accounting Standards Board as the reporting of an entity that is organized with a parent company and subsidiaries.

Students also viewed these Business questions

-

Use Samsungs December 31, 2017, financial statements in Appendix A near the end of the text to answer the following. a. Identify the amounts (in millions of Korean won) of Samsungs 2017 (1) Assets,...

-

The following financial statement information is from five separate companies. Required 1. Answer the following questions about Company V. a. What is the amount of equity on December 31, 2018? b....

-

Samsungs statement of cash flows in Appendix A reports the change in cash and equivalents for the year ended December 31, 2017. Identify the cash generated (or used) by operating activities, by...

-

Identify and describe a time (that you would be comfortable sharing for the purposes of this assignment) when you faced a challenge in a friendship, like a betrayal or geographic distance.

-

A current of 2.50 A is carried by a copper wire of radius 1.00 mm. If the density of the conduction electrons is 8.47 1028 m3, what is the drift speed of the conduction electrons?

-

Which of the following alternatives to the underlined portion would NOT be acceptable? F. Needs. Interpreting G. Needs; interpreting H. Needs, so J. Needs, interpreting

-

The following data are taken from the unadjusted trial balance of the Westcott Company at December 31, 2013. Each account carries a normal balance and the accounts are shown here in alphabetical...

-

Fazel Chairs, Inc., makes two types of chairs. Model Diamond is a high-end product designed for professional offices. Model Gold is an economical product designed for family use. Irene Fazel, the...

-

Prepare the closing entries dated December 3 1 , 2 0 2 2 . ( If no entry is required for a transaction / event , select " No Jourr Required" in the first account field. ) 1 5 points View transaction...

-

Buckeye Manufacturing produces heads for engines used in the manufacture of trucks. The production line is highly complex, and it measures 900 feet in length. Two types of engine heads are produced...

-

Refer to Samsungs financial statements in Appendix A. Compute its cost of goods available for sale for the yearended December 31, 2017. Data from Appendix A Apple Inc. CONSOLIDATED BALANCE SHEETS (In...

-

A solar panel dealer acquires a used panel for $9,000, with terms FOB shipping point. Compute total inventory costs assigned to the used panel if additional costs include$1,500 for sales staff...

-

When overhead is overapplied, is the balance of cost of good sold, before adjustment, too low or too high? Why?

-

Consider the project information in the table below: Draw and analyze a project network diagram to answer the following questions: a. If you were to start on this project, which are the activities...

-

Lacey, Inc., had the following sales and purchase transactions during 2011. Beginning inventory consisted of 80 items at \(\$ 120\) each. Lacey uses the FIFO cost flow assumption and keeps perpetual...

-

Refer to the Camp Sunshine data presented in E5-9. Required: 1. Perform a least-squares regression analysis on Camp Sunshines data. 2. Using the regression output, create a cost equation (Y = A + BX)...

-

The following information pertains to the first year of operation for Sonic Boom Radios, Inc. Required: Prepare Sonic Booms full absorption costing income statement and variable costing income...

-

Jane Crawford, the president of Crawford Enterprises, is considering two investment opportunities. Because of limited resources, she will be able to invest in only one of them. Project A is to...

-

In Problem find an equation of the form Ax + By = C for the given line. The vertical line through (-6, 3)

-

Juarez worked for Westarz Homes at construction sites for five years. Bever was a superintendent at construction sites, supervising subcontractors and moving trash from sites to landfills. He...

-

Set up T-accounts for the following accounts and amounts with normal balances as of December 31: K. Korver, Capital $18,000; K. Korver, Withdrawals $2,000; Services Revenue $33,000; Salaries Expense...

-

The adjusted trial balance of Karise Repairs on December 31 follows. Required 1. Prepare an income statement and a statement of owners equity for the year, and a classified balance sheet at December...

-

The adjusted trial balance for Anara Co. on December 31 of the current year follows. Petra Anara invested $40,000 cash in the business during the year. The P. Anara, Capital account balance was...

-

i need help in B and C Integrative Case 5-72 (Algo) Cost Estimation, CVP Analysis, and Decision Making (LO 5-4.5.9) Luke Corporation produces a variety of products, each within their own division....

-

Relate PSA (Public Securities Association) speed to the average life of a MBS. Describe the PSA measure and discuss which MBS would have the greater average life, one with a PSA of 100 or one with a...

-

Which of the following statement about swaps is least accurate? A. In a plain vanilla interest rate swap, the notional principal is swapped. B. The default problem [i.e. default risk] is the most...

Study smarter with the SolutionInn App