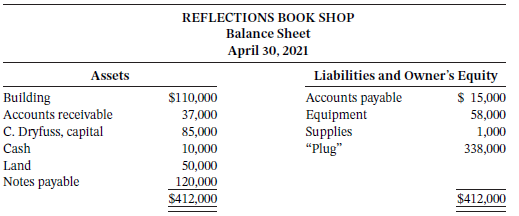

The balance sheet of Reflections Book Shop at April 30, 2021, is as follows: Charles Dryfuss, the

Question:

The balance sheet of Reflections Book Shop at April 30, 2021, is as follows:

Charles Dryfuss, the owner of the book shop, admits that he is not an accountant. In fact, he couldn?t get the balance sheet to balance without ?plugging? the numbers (making up numbers to give the desired result). He gives you the following additional information:

1. A professional real estate appraiser estimated the value of the land at $50,000. The actual cost of the land was $36,000.

2. Accounts receivable include amounts due from customers in China for 35,000 yuan, which is about $5,000 Canadian. Dryfuss didn?t know how to convert the currency for reporting purposes so he added the 35,000 yuan to the $2,000 due from Canadian customers. He thought it more important to know how much he was owed by each customer in the currency they would likely pay him with anyway.

3. Dryfuss reasons that equipment is a liability because it will cost him money in the future to maintain these items.

4. Dryfuss reasons that the note payable must be an asset because getting the loan was good for the business. If he had not obtained the loan, he would not have been able to purchase the land and buildings.

5. Dryfuss believes that his capital account is also an asset. He has invested in the business, and investments are assets; therefore his capital account is an asset.

Instructions

a. Identify any corrections that should be made to the balance sheet, and explain why by referring to the appropriate accounting principle, assumption, or concept.

b. Prepare a corrected balance sheet for Reflections Book Shop at April 30. The capital account may need to be adjusted in order to balance.

Taking It Further

Explain to Dryfuss why all transactions affect at least two financial statement items.

Step by Step Answer:

Accounting Principles Volume 1

ISBN: 978-1119502425

8th Canadian Edition

Authors: Jerry J. Weygandt, Donald E. Kieso, Paul D. Kimmel, Barbara Trenholm, Valerie Warren, Lori Novak