The three partners of Summer Springs Medical Clinic agree to liquidate their partnership on September 15, 2021.

Question:

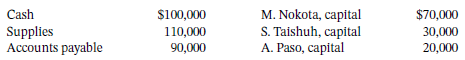

The three partners of Summer Springs Medical Clinic agree to liquidate their partnership on September 15, 2021. At that point, the accounting records show the following balances:

The three partners share profit and loss 50%, 25%, and 25%, for Nokota, Taishuh, and Paso, respectively.

Instructions

a. Journalize the liquidation of the partnership on September 30 under each of the following independent assumptions:

1. The supplies are sold for $130,000 cash, the liabilities are paid, and the remaining cash is paid to the partners.

2. The supplies are sold for $25,000 cash and the liabilities are paid. Assume that any partners with a debit capital balance pay the amount owed to the partnership.

b. Refer to item 2 in part (a) above. Assume instead that any partners with a debit capital balance are unable to pay the amount owed to the partnership. Journalize the reallocation of the deficiency and final distribution of cash to the remaining partners.

Taking It Further

For what reasons would a partnership decide to liquidate?

DistributionThe word "distribution" has several meanings in the financial world, most of them pertaining to the payment of assets from a fund, account, or individual security to an investor or beneficiary. Retirement account distributions are among the most... Liquidation

Liquidation in finance and economics is the process of bringing a business to an end and distributing its assets to claimants. It is an event that usually occurs when a company is insolvent, meaning it cannot pay its obligations when they are due.... Partnership

A legal form of business operation between two or more individuals who share management and profits. A Written agreement between two or more individuals who join as partners to form and carry on a for-profit business. Among other things, it states...

Step by Step Answer:

Accounting Principles Volume 2

ISBN: 978-1119502555

8th Canadian Edition

Authors: Jerry J. Weygandt, Donald E. Kieso, Paul D. Kimmel, Barbara Trenholm, Valerie Warren, Lori Novak