Use Apples financial statements in Appendix A to answer the following. 1. Is Apples statement of cash

Question:

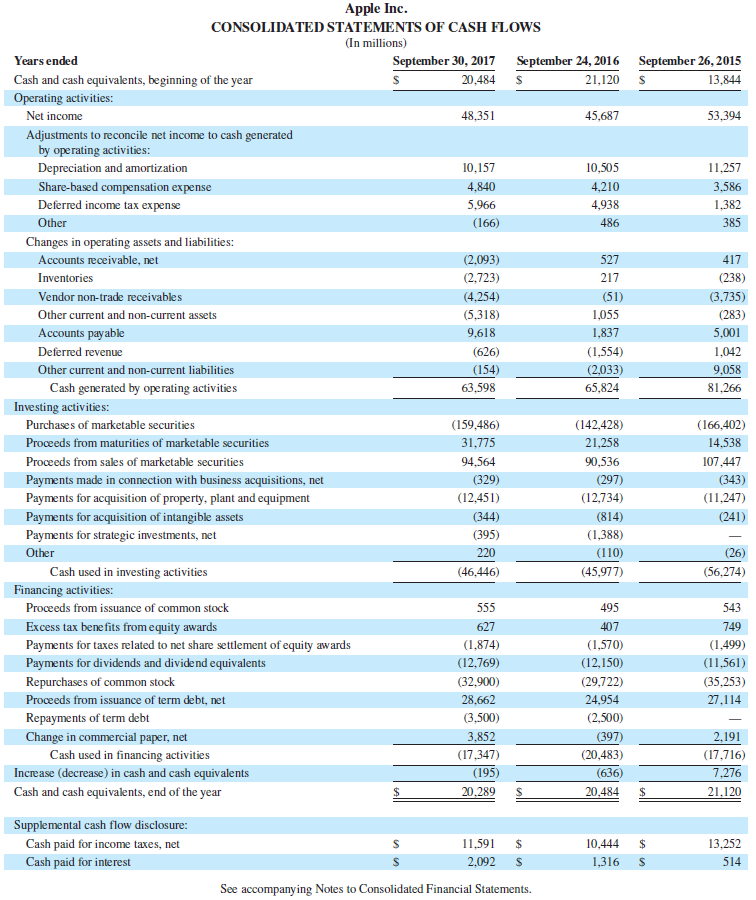

Use Apple’s financial statements in Appendix A to answer the following.

1. Is Apple’s statement of cash flows prepared under the direct method or the indirect method?

2. For each fiscal year 2017, 2016, and 2015, identify the amount of cash provided by operating activities and cash paid fordividends.

3. In 2017, did Apple have sufficient cash flows from operations to pay dividends?

4. Did Apple spend more or less cash to repurchase common stock in 2017 versus 2016?

Data from Apple’s

Transcribed Image Text:

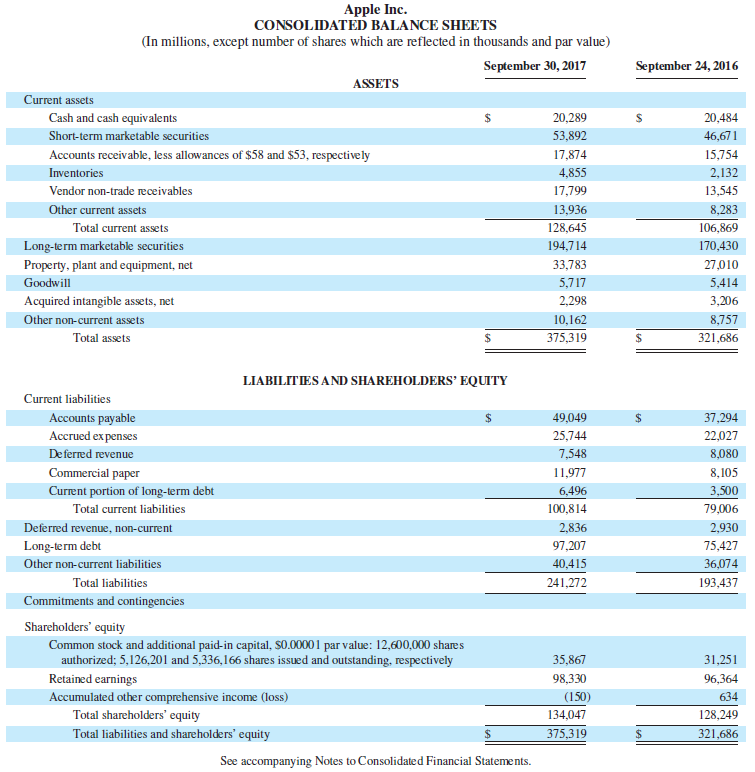

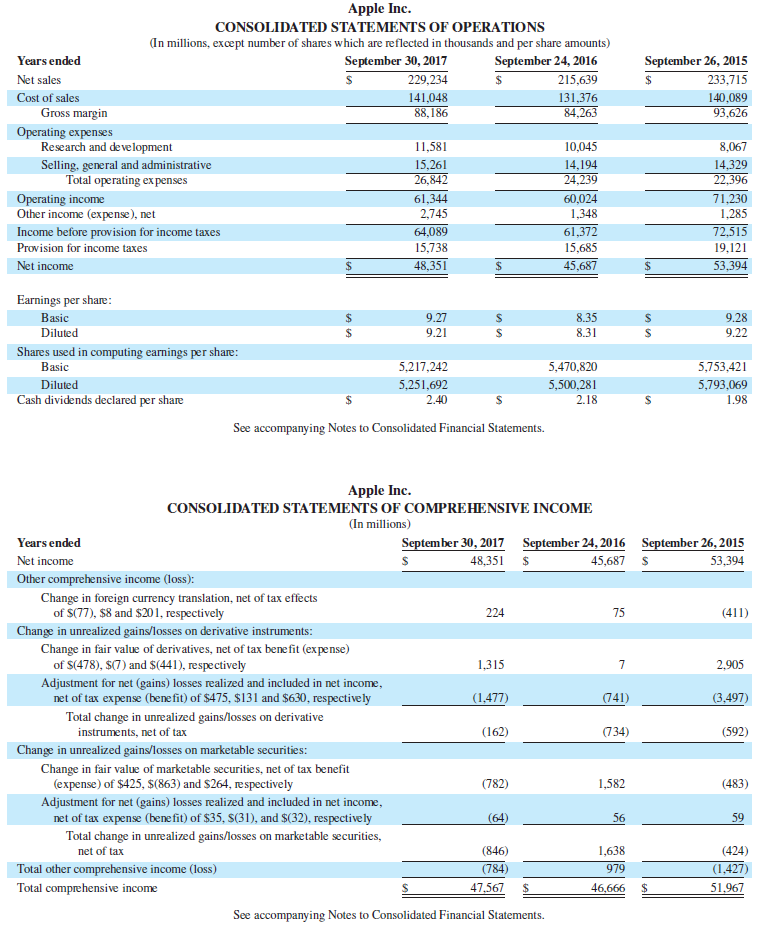

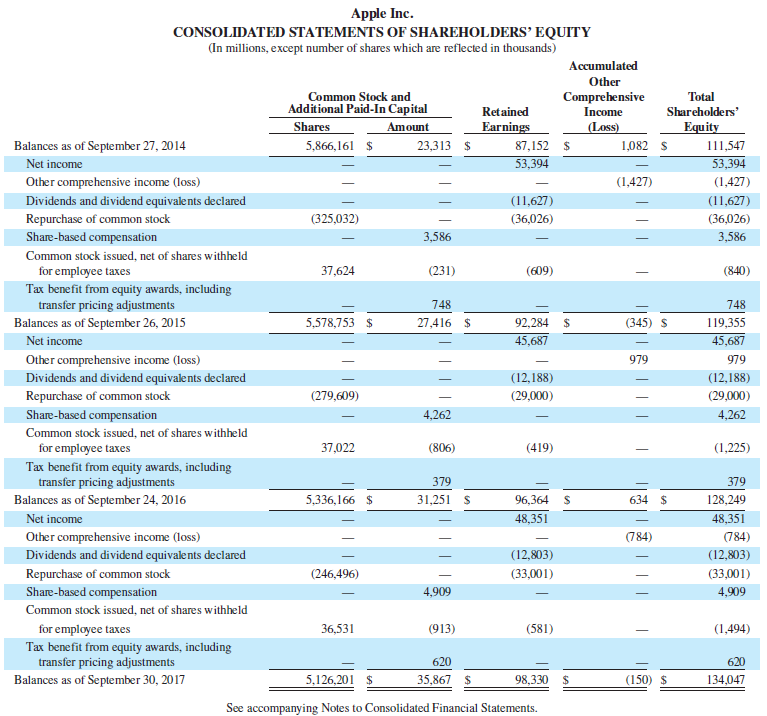

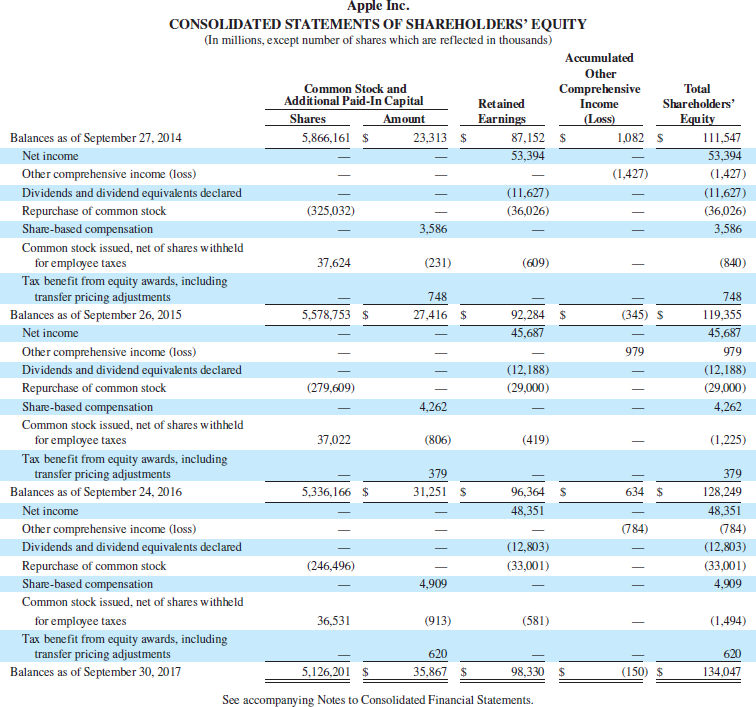

Apple Inc. CONSOLIDATED BALANCE SHEETS (In millions, except number of shares which are reflected in thousands and par value) September 24, 2016 September 30, 2017 ASSETS Current assets 24 20,484 Cash and cash equivalents 20,289 53,892 Short-term marketable securities 46,671 Accounts receivable, less allowances of $58 and $53, respectively 17,874 15,754 Inventories 4,855 2,132 Vendor non-trade receivables 17,799 13,545 Other current assets 13,936 8,283 128,645 Total current assets 106,869 170,430 Long-term marketable securities 194,714 Property, plant and equipment, net 33,783 27,010 Goodwill 5,717 5,414 2.298 Acquired intangible assets, net 3,206 Other non-current assets 10,162 8,757 375,319 Total assets 321,686 LIABILITIES AND SHAREHOLDERS' EQUITY Current liabilities 37,294 Accounts payable Accrued ex penses 49,049 25,744 22,027 7,548 De ferred revenue 8,080 Commercial paper 11,977 8,105 Current portion of long-term debt 6,496 3,500 100,814 Total current liabilities 79,006 Deferred revenue, non-current 2,836 2,930 97,207 Long-term debt 75,427 Other non-current liabilities 40,415 36,074 193,437 Total liabilities 241,272 Commitments and contingencies Shareholders' equity Common stock and additional paid-in capital, S0.00001 par value: 12,600,000 shares authorized; 5,126,201 and 5,336,166 shares issued and outstanding, respectively Retained earnings 35,867 31,251 98,330 96,364 Accumulated other comprehensive income (loss) Total shareholders' equity (150) 634 134,047 128,249 Total liabilities and shareholders' equity 375,319 321,686 See accompanying Notes to Consolidated Financial Statements. Apple Inc. CONSOLIDATED STATEMENTS OF OPERATIONS (In millions, except number of shares which are reflected in thousands and per share amounts) Years ended September 30, 2017 September 24, 2016 September 26, 2015 Net sales 229,234 215,639 24 233,715 Cost of sales 141,048 131,376 84,263 140,089 93,626 Gross margin 88,186 Operating expenses Research and development 11,581 10,045 8,067 Selling, general and administrative Total operating ex penses 15,261 26,842 14,194 24,239 14,329 22.396 Operating income Other income (expense), net 60,024 1,348 71,230 61,344 2,745 1,285 Income before provision for income taxes 64,089 61,372 72,515 Provision for income taxes 15,738 15,685 19,121 Net income 48,351 45,687 53,394 Earnings per share: Basic Diluted %24 9.27 8.35 %24 9.28 9.21 8.31 9.22 Shares used in computing earnings per share: Basic 5,217,242 5,470,820 5,753,421 Diluted 5,251,692 5,500,281 5,793,069 Cash dividends declared per share 2.40 2.18 1.98 See accompanying Notes to Consolidated Financial Statements. Apple Inc. CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (In millions) September 30, 2017 September 24, 2016 September 26, 2015 Years ended Net income 48,351 45,687 S 53,394 Other comprehensive income (loss): Change in foreign currency translation, net of tax effects of S(77), $8 and $201, respectively 224 75 (411) Change in unrealized gains/losses on derivative instruments: Change in fair value of derivatives, net of tax benefit (expense) of S(478), $(7) and $(441), respectively 1,315 2,905 Adjustment for net (gains) losses realized and included in net income, net of tax expense (bene fit) of $475, $131 and $630, respective ly Total change in unrealized gains/losses on derivative instruments, net of tax (1,477) (741) (3,497) (162) (734) (592) Change in unrealized gains/losses on marketable securities: Change in fair value of marketable securities, net of tax benefit (expense) of $425, $(863) and $264, respectively (782) 1,582 (483) Adjustment for net (gains) losses realized and included in net income, net of tax expense (bene fit) of $35, S(31), and $(32), respectively Total change in unrealized gains/losses on marketable securities, net of tax (64) 56 59 (846) 1,638 (424) Total other comprehensive income (loss) (784) 979 (1,427 Total comprehensive income 47,567 46,666 51,967 See accompanying Notes to Consolidated Financial Statements.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 38% (13 reviews)

1 Indirect Method Explanation We readily know this because the operating activity section ...View the full answer

Answered By

Qurat Ul Ain

Successful writing is about matching great style with top content. As an experienced freelance writer specialising in article writing and ghostwriting, I can provide you with that perfect combination, adapted to suit your needs.

I have written articles on subjects including history, management, and finance. Much of my work is ghost-writing, so I am used to adapting to someone else's preferred style and tone. I have post-graduate qualifications in history, teaching, and social science, as well as a management diploma, and so am well equipped to research and write in these areas.

4.80+

265+ Reviews

421+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

Refer to Apple's financial statements in Appendix A to answer the following. 1. Using fiscal 2012 as the base year, compute trend percents for fiscal years 2012, 2013, and 2014 for net sales, cost of...

-

Refer to Apple's financial statements in Appendix A to answer the following. 1. What is the amount of Apple's accounts receivable as of September 26, 2015? 2. Compute Apple's accounts receivable...

-

Refer to Apple's financial statements in Appendix A to answer the following. Required 1. What amount of inventories did Apple report as a current asset on September 27, 2014? On September 28, 2013?...

-

Why does Erasmus attack Church officials in his In Praise of Folly? O For spending money on lavish art O For not allowing clergy to marry O For supporting military campaigns O For selling pardons and...

-

What is the heat capacity of a gold ring that has a mass of 5.00 g?

-

How does the resource-based view of the firm provide a superior means of evaluating a companys competitive advantage?

-

Are facilities strategically located close to resources and markets?

-

Ashes Divide Corporation has bonds on the market with 14.5 years to maturity, a YTM of 6.8 percent, and a current price of $924. The bonds make semiannual payments. The coupon rate on these bonds...

-

Find the monthly payments on a 2-year lease for a $29,107 car if the car's residual value is $15,708 and the lease has an annual interest rate of 3.8%.

-

Jaylen has asked you to make a retirement planning presentation to the employees at Troy Metals Inc. as part of a financial literacy day. Your presentation will last approximately 60 minutes with...

-

For each of the following separate cases, compute the required cash flow information. Case Z: Compute cash paid for inventory Cost of goods sold.. Inventory, Beginning balance Accounts payable,...

-

Key figures for Apple and Google follow. Required 1. Compute the recent two years cash flow on total assets ratios for Apple and Google. 2. For the current year, which company has the better cash...

-

Estimate the fugacity of one of the following: (a) Cyclopentane at 110C and 275 bar. At 110C the vapor pressure to cyclopcntane is 5.267 bar. (A) 1-Butene at 120C and 34 bar, At 120C the vapor...

-

Below are incomplete financial statements for Hurricane, Incorporated Required: Calculate the missing amounts. Complete this question by entering your answers in the tabs below. Income Statement Stmt...

-

TBTF Incorporated purchased equipment on May 1, 2021. The company depreciates its equipment using the double-declining balance method. Other information pertaining to the equipment purchased by TBTF...

-

Coco Ltd. manufactures milk and dark chocolate blocks. Below is the information relating to each type of chocolate. Milk Chocolate Selling price per unit $6 Variable cost per unit $3 Sales mix 4 Dark...

-

Data related to 2018 operations for Constaga Products, a manufacturer of sewing machines: Sales volume 5,000 units Sales price $300.00 per unit Variable production costs Direct materials 75.00 per...

-

6. (20 points) Sections 3.1-3.5, 3.7 Differentiate the following functions, state the regions where the functions are analytic. a. cos(e*) b. 1 ez +1 c. Log (z+1) (Hint: To find where it is analytic,...

-

Animals in an experiment are to be kept under a strict diet. Each animal should receive 20 grams of protein and 6 grams of fat. The laboratory technician is able to purchase two food mixes: Mix A has...

-

Starr Co. had sales revenue of $540,000 in 2014. Other items recorded during the year were: Cost of goods sold ..................................................... $330,000 Salaries and wages...

-

Googles Fitbit division makes fitness trackers. Assume the following data from Google. 1. Compute cost per unit for (a) A noncustom (standard) fitness tracker and (b) A custom tracker with a company...

-

Apple allows customers to select different cases for the watches it produces and sells. Assume the following data for the newest Apple Watch. 1. Compute cost per unit for an Apple watch with either...

-

Based on customer interest in February, Santana expands her computer workstation furniture business to include mass production of standardized desks and chairs. She uses the weighted average method...

-

QUESTION 3 A business owns seven flats rented out to staff at R500 per month. All flats were tenanted Ist january 21 months rent was in arrears and as at 31st December 14 months' rent wa Identify the...

-

1. 2. 3. Select the Tables sheet, select cells A6:B10, and create range names using the Create from Selection button [Formulas tab, Defined Names group]. Select cells B1:F2 and click the Name box....

-

Tropical Rainwear issues 3,000 shares of its $18 par value preferred stock for cash at $20 per share. Record the issuance of the preferred shares. (If no entry is required for a particular...

Study smarter with the SolutionInn App