Question:

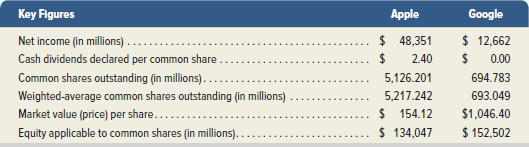

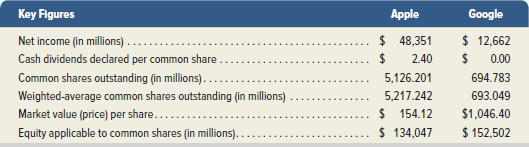

Use the following comparative figures for Apple and Google.

Required

1. Compute the book value per common share for each company using these data.

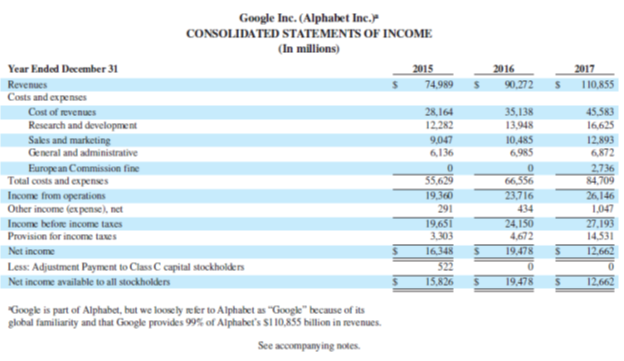

2. Compute the basic EPS for each company using these data.

3. Compute the dividend yield for each company using these data.

4. Compute the price-earnings ratio for each company using these data.

5. Based on the PE ratio, for which company do investors have greater expectations about future performance?

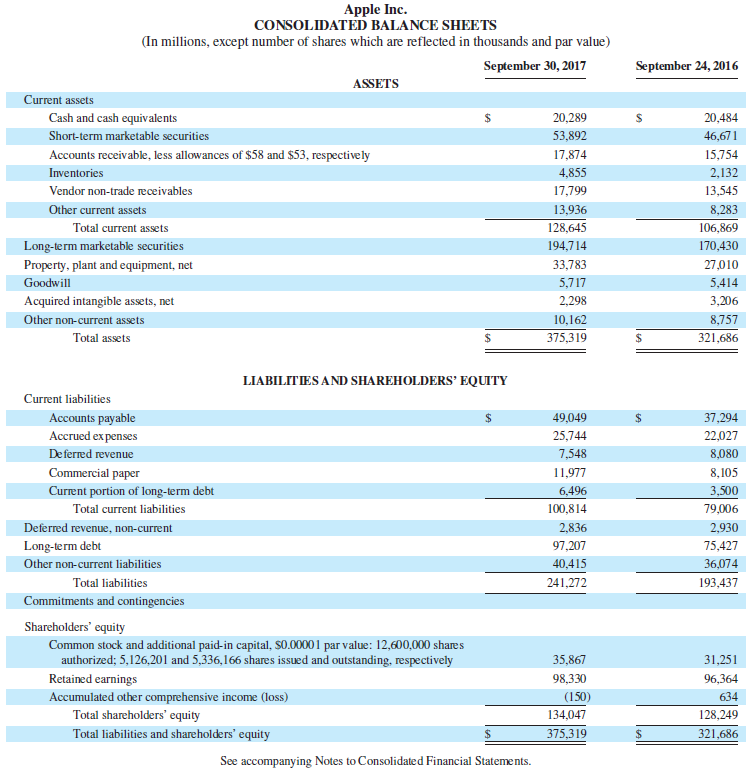

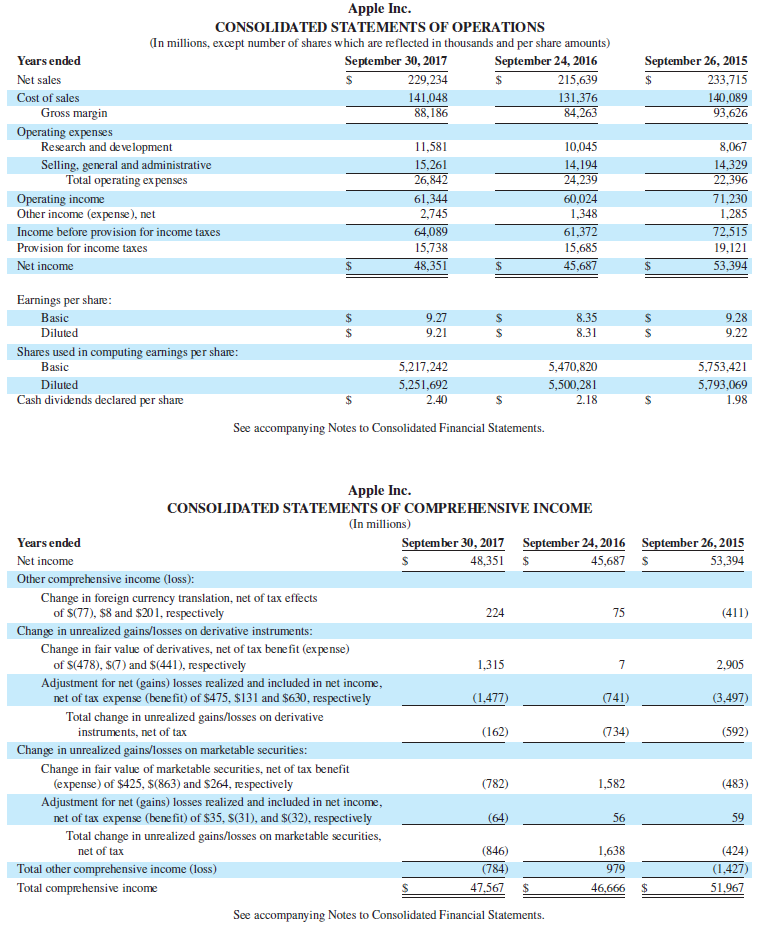

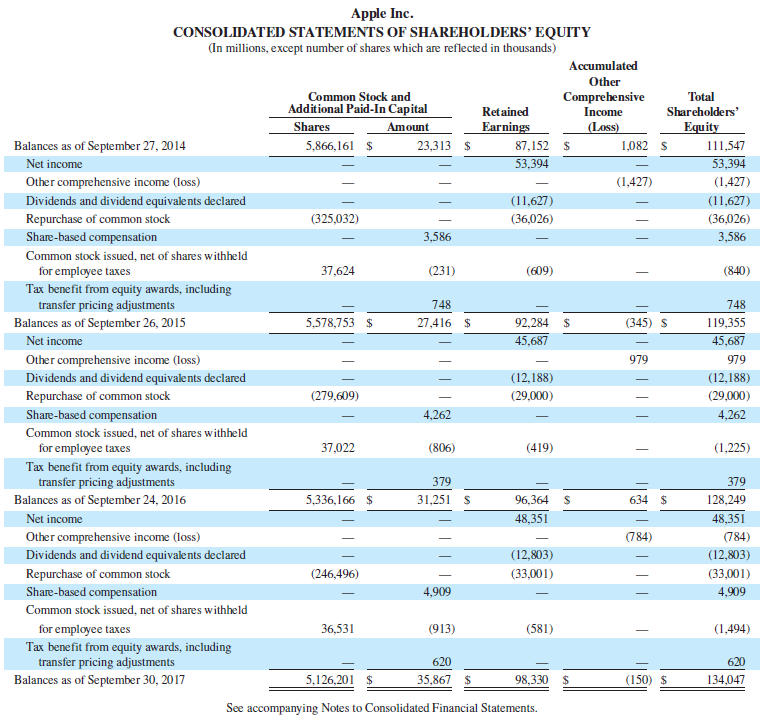

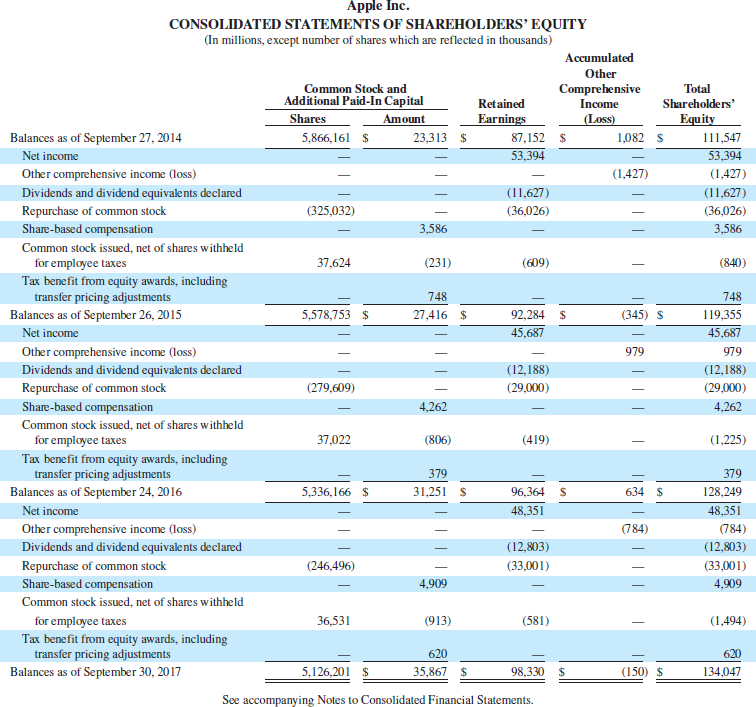

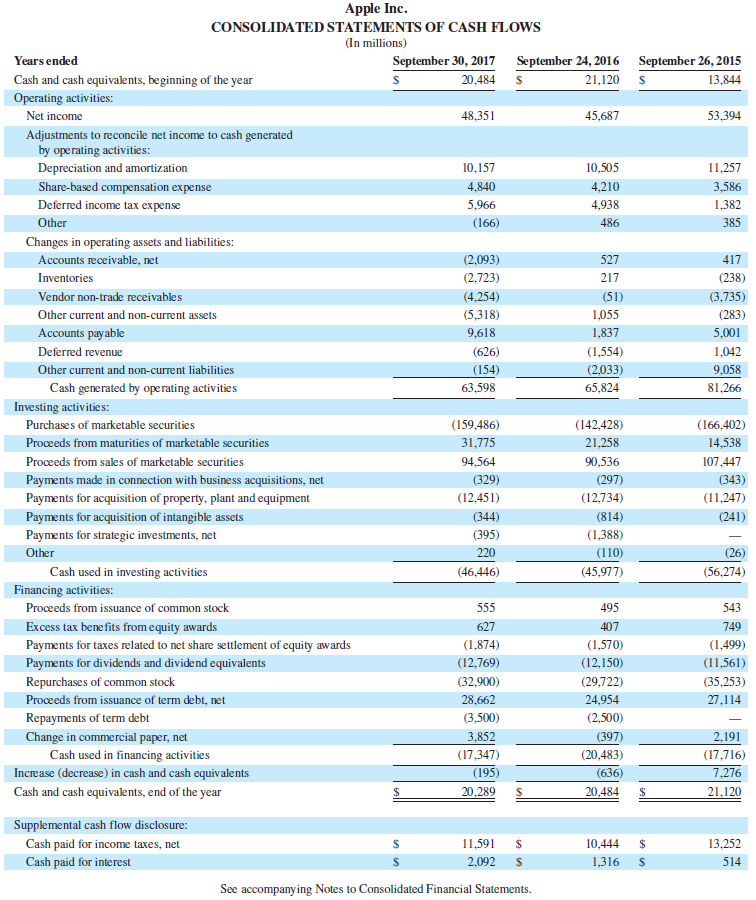

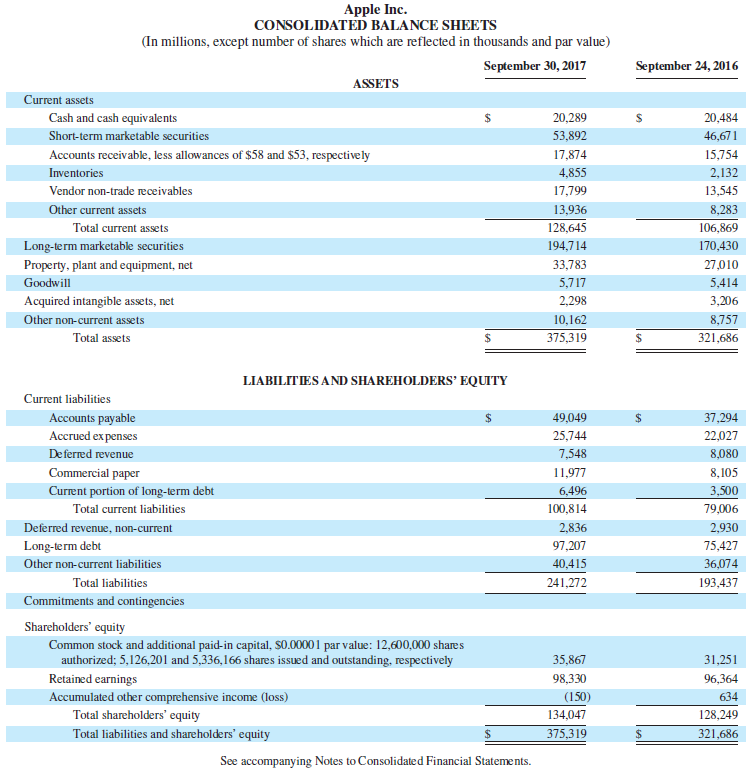

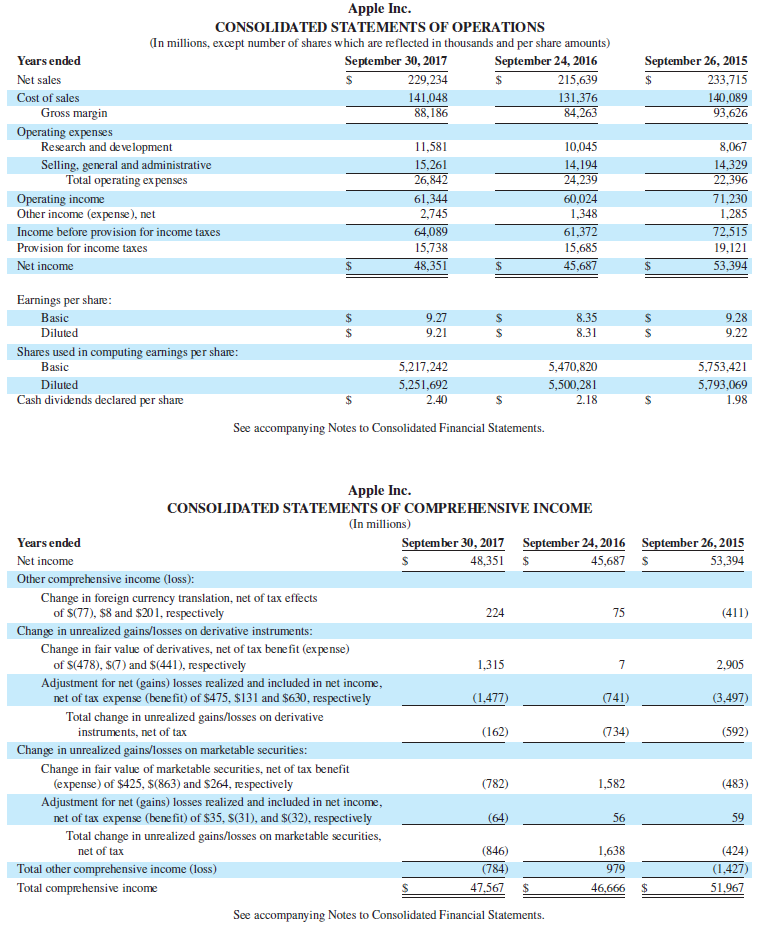

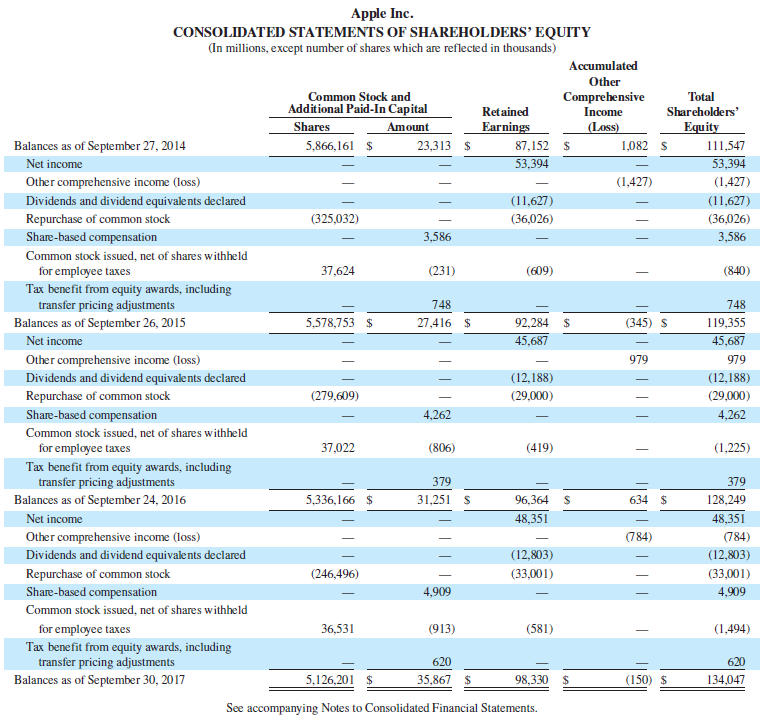

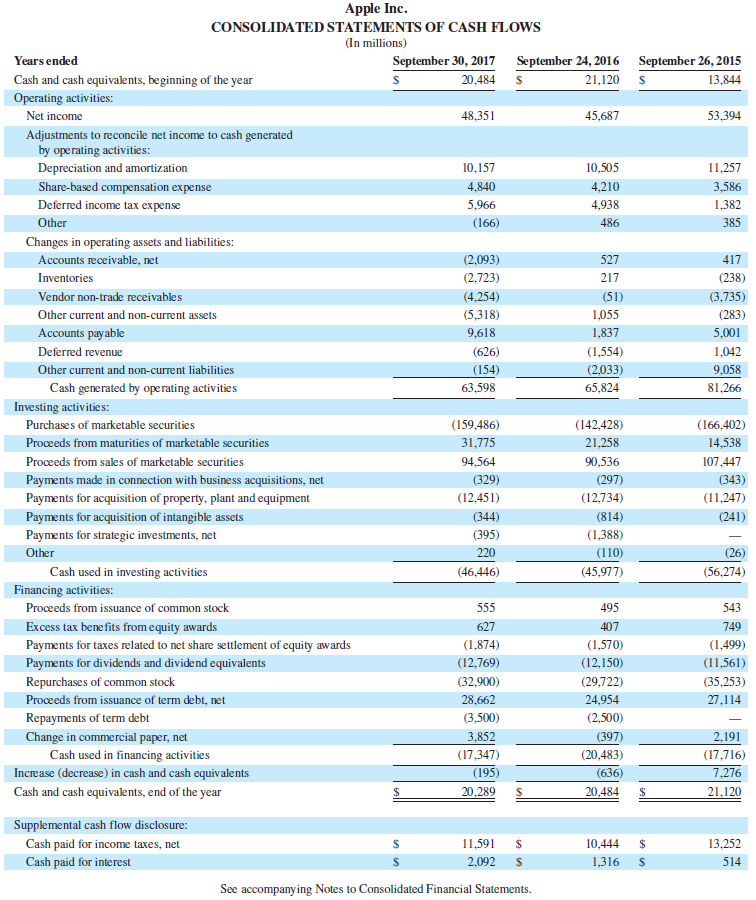

Data from Apple’s

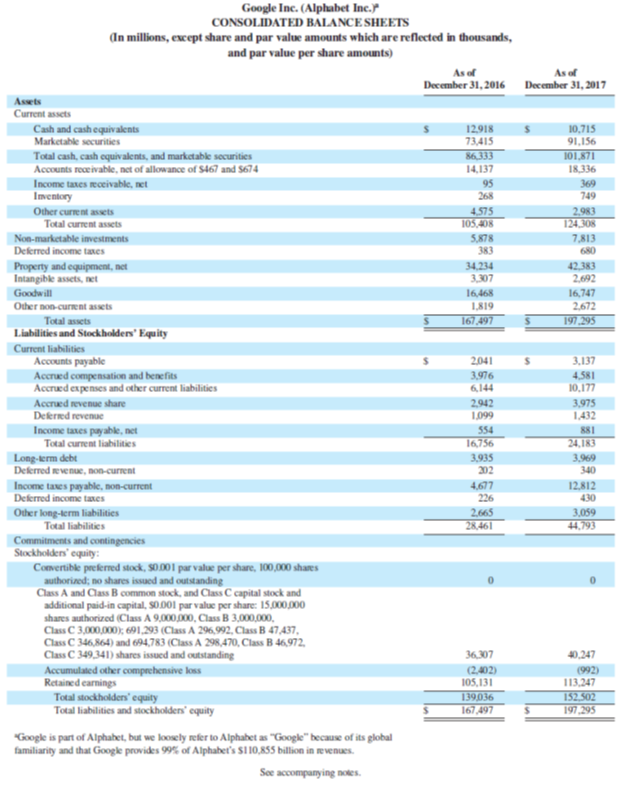

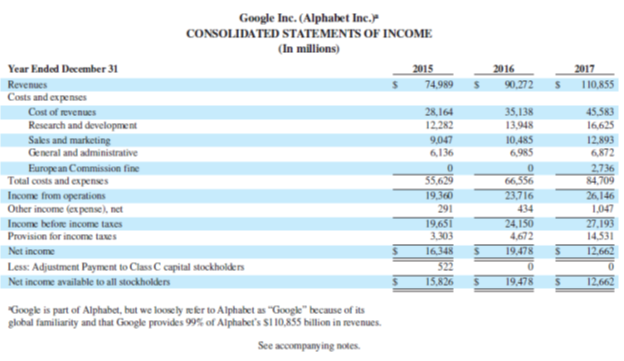

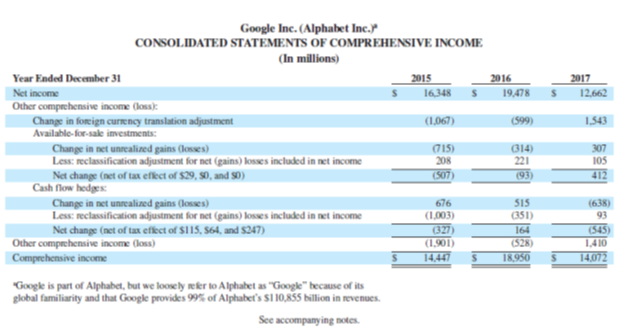

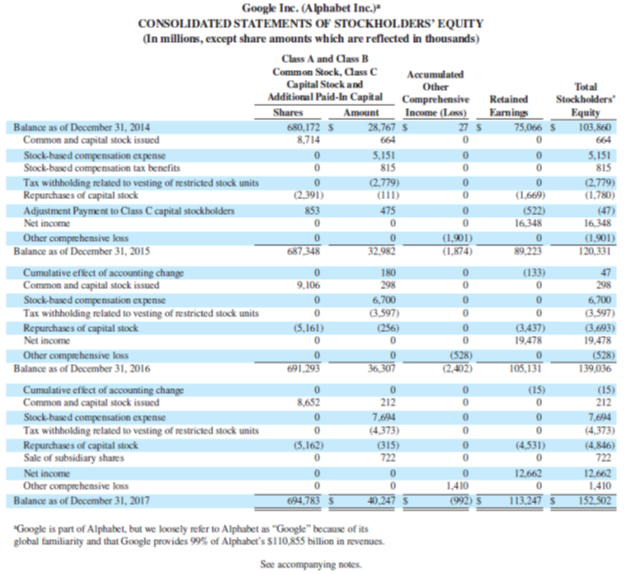

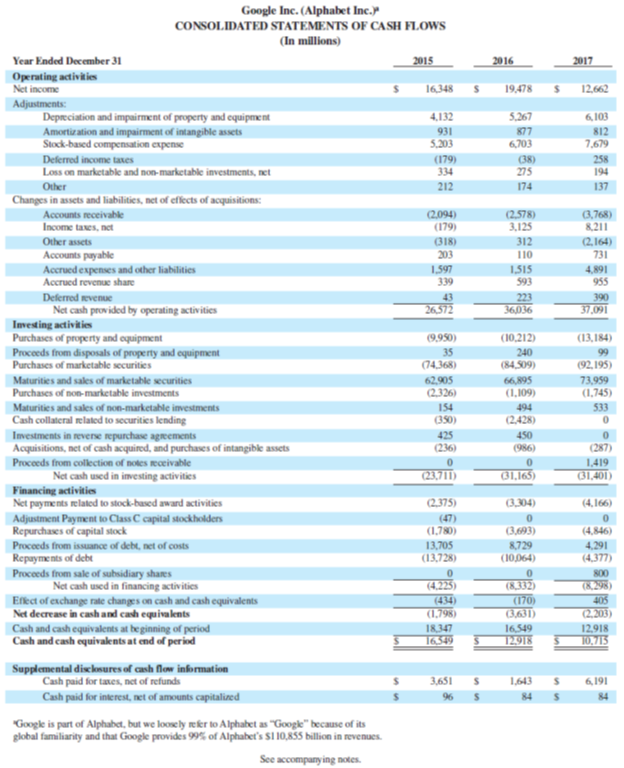

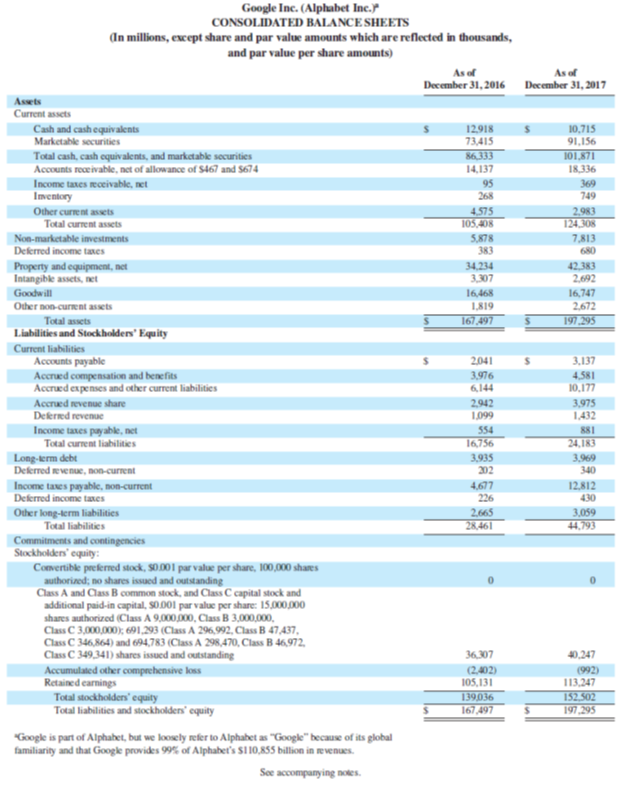

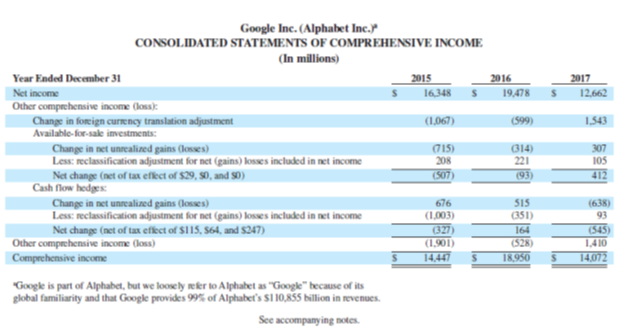

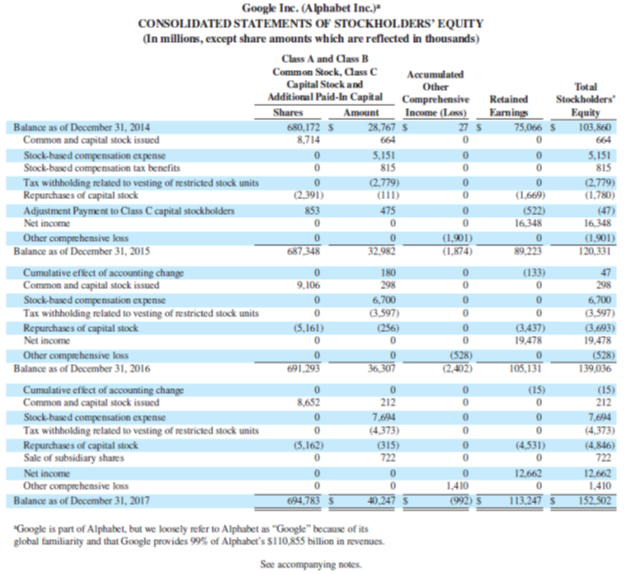

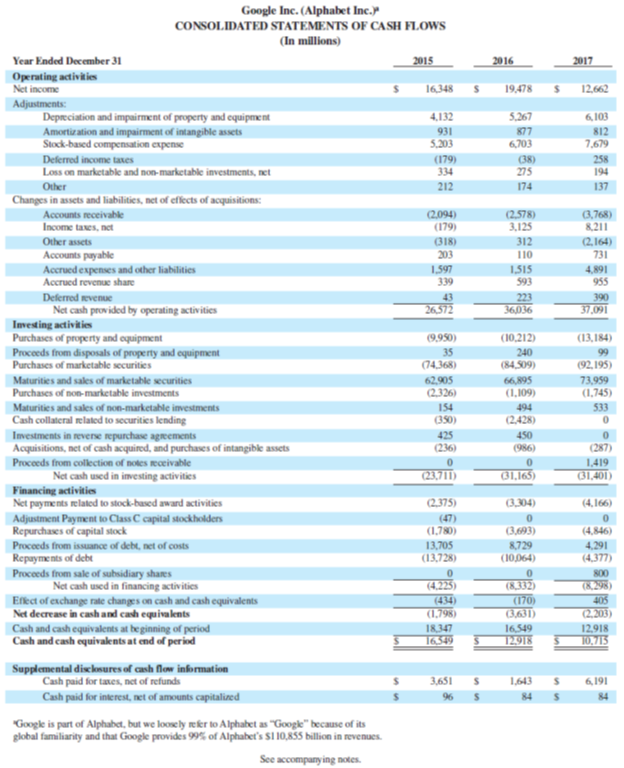

Data from Google's

Dividend Yield

Dividend yield refers to a stock's annual dividend payments to shareholders, expressed as a percentage of the stock's current price. The dividend per share that a company pays divided by the share price. This is reported on the financial statements...

Transcribed Image Text:

Key Figures Google Apple $ 48,351 Net income (in millions) . Cash dividends declared per common share.. Common shares outstanding (in millions).... Weighted-average common shares outstanding (in millions) Market value (price) per share.... Equity applicable to common shares (in millions). $ 12,662 2.40 5,126.201 5,217.242 $ 154.12 0.00 694.783 693.049 $1,046.40 $ 134,047 $ 152,502 Apple Inc. CONSOLIDATED BALANCE SHEETS (In millions, except number of shares which are reflected in thousands and par value) September 30, 2017 September 24, 2016 ASSETS Current assets Cash and cash equivalents 24 20,289 20,484 Short-term marketable securities 53,892 46,671 Accounts receivable, less allowances of $58 and $53, respectively 17,874 15,754 Inventories 4,855 2,132 Vendor non-trade receivables 17,799 13,545 Other current assets 13,936 8,283 Total current assets 128,645 106,869 Long-term marketable securities 194,714 170,430 Property, plant and equipment, net 33,783 27,010 Goodwill 5,717 5,414 Acquired intangible assets, net 2.298 3,206 Other non-current assets 10,162 8,757 Total assets 375,319 321,686 LIABILITIES AND SHAREHOLDERS' EQUITY Current liabilities 37,294 Accounts payable Accrued ex penses 49,049 25,744 22,027 De ferred revenue 7,548 8,080 Commercial paper 11,977 8,105 Current portion of long-term debt 6,496 3,500 Total current liabilities 100,814 79,006 Deferred revenue, non-current 2,836 2,930 Long-term debt 97,207 75,427 Other non-current liabilities 40,415 36,074 Total liabilities 241,272 193,437 Commitments and contingencies Shareholders' equity Common stock and additional paid-in capital, S0.00001 par value: 12,600,000 shares authorized; 5,126,201 and 5,336,166 shares issued and outstanding, respectively Retained earnings 35,867 31,251 98,330 96,364 Accumulated other comprehensive income (loss) Total shareholders' equity (150) 634 134,047 128,249 Total liabilities and shareholders' equity 375,319 321,686 See accompanying Notes to Consolidated Financial Statements.