Zest Company is a Montreal HR firm. Its condensed income statement for the year ended November 30,

Question:

Zest Company is a Montreal HR firm. Its condensed income statement for the year ended November 30, 2020, is shown below.

? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ?Zest Company? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? Income Statement? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ?For Year Ended November 30, 2020Consulting revenue .............................................................. $863,500Operating expenses ............................................................. 512,800Profit ...................................................................................... $350,700

The liabilities reported on the November 30, 2020, balance sheet were:

Accounts payable ....................................................................$ 26,230Mortgage payable ................................................................... 328,698Total liabilities ........................................................................ $354,928

Marie Martin, the owner, is looking for additional financing. A potential lender has reviewed Zest?s accounting records and discovered the following:

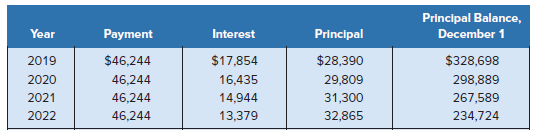

a. Mortgage payments are made annually each December 1. The December 1, 2020, payment has not yet been made or recorded. A partial amortization schedule for the mortgage follows:

b. Consulting revenue included $85,000 received for work to be done in January and February 2021.

c. Accrued salaries at November 30, 2020, totalling $11,500 have not been recorded.

d. $7,000 of office supplies purchased on account were received November 28; this transaction was not recorded.

e. Annual property taxes of $17,500 are due each December 1; no property taxes have been included on the income statement.

Required

Using the information provided, prepare a corrected income statement and liabilities section of the balance sheet.

Analysis Component: If you were paid an annual bonus based on profit, what ethical dilemma would you face regarding the above items?

Balance SheetBalance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial...

Step by Step Answer:

Fundamental Accounting Principles Volume II

ISBN: 978-1260305838

16th Canadian edition

Authors: Kermit Larson, Tilly Jensen, Heidi Dieckmann